0

US Dollar Index

The US dollar index remained around 97.60 on Wednesday, rising slightly as the partial government shutdown delayed the release of key economic data, keeping investors cautious. The latest job openings data and the January jobs report, both scheduled for release this week, were postponed, failing to provide new signals about the health of the US labor market. President Donald Trump signed a $1.2 trillion budget to end the partial shutdown, although funding issues for the Department of Homeland Security remain unresolved. Meanwhile, the dollar rose in recent trading after Trump nominated Kevin Warsh as the next Federal Reserve chairman, a candidate considered less dovish than others, while strong US manufacturing data eased expectations of rapid rate cuts. The market still expects the Fed to cut rates twice this year, possibly in June and October.

In the first ten days of the week, the US dollar index rose initially before falling, rebounding strongly to close at 97.73. Overall, it is in a phase of technical correction followed by a tug-of-war between bulls and bears, with the rebound leaning more towards a technical correction after oversold conditions than a trend reversal. The medium- to long-term downtrend structure remains intact. Prices rebounded briefly but remain below the 10-day and 20-day moving averages, which are in a bearish alignment. The RSI indicator, after moving out of the previous oversold zone and rising to around 60, failed to sustain its upward momentum, indicating weakening upward momentum and difficulty for bulls to push the index to continue its strong rebound. It is expected to fluctuate between 97.00 and 97.80 this week, with a breakout requiring data or policy catalysts. Therefore, watch for upward movement at 98.00 (the psychological level) and 97.73 (Monday's high). Support levels to watch are 97.00 and the 96.91 (5-day moving average) area.

Today, consider shorting the US dollar index around 97.75; stop loss: 97.85; target: 97.30; 97.20

WTI Crude Oil

US crude oil is trading around $64.250 per barrel, rebounding driven by escalating international geopolitical risks. Oil prices rebounded significantly, driven by escalating international geopolitical risks. This followed the downing of an Iranian drone by the US military in the Arabian Sea that approached its aircraft carrier, and reports of Iranian armed speedboats nearing a US oil tanker in the Strait of Hormuz. These events heightened market concerns that US-Iran tensions could disrupt diplomatic dialogue between the two countries. Besides the Middle East situation, other factors also supported oil prices. Earlier on Tuesday, a trade agreement reached between the US and India boosted the outlook for global energy demand growth. Meanwhile, the ongoing conflict between Russia and Ukraine, with Ukrainian President Zelensky accusing Russia of stockpiling ammunition during the ceasefire and launching attacks before peace talks, deepened market expectations that sanctions against Russian oil would continue indefinitely, thus supporting oil prices.

From the daily chart, the $64 (psychological level) and $64.50 levels have become key areas of short-term bullish and bearish struggles. This level is both the starting point of the previous rebound and an important support zone on the daily chart. If this support area fails to hold, a further downward correction may occur on the daily chart, with the potential pullback to $61.10 (the 20-day moving average), followed by $60 (a psychological level). Conversely, if the price stabilizes and consolidates effectively in the $64.00-$64.50 area, a technical rebound is possible, but its extent will still be limited by the moving average system above. On the upside, the $64.50-$64.00 range constitutes significant technical resistance; this area is not only a previous consolidation platform but also a densely packed area of short-term moving averages. A break below this level would target $66.24 (the high of January 29th).

Today, consider going long on crude oil around 64.08; Stop loss: 63.95; Target: 65.30; 65.50

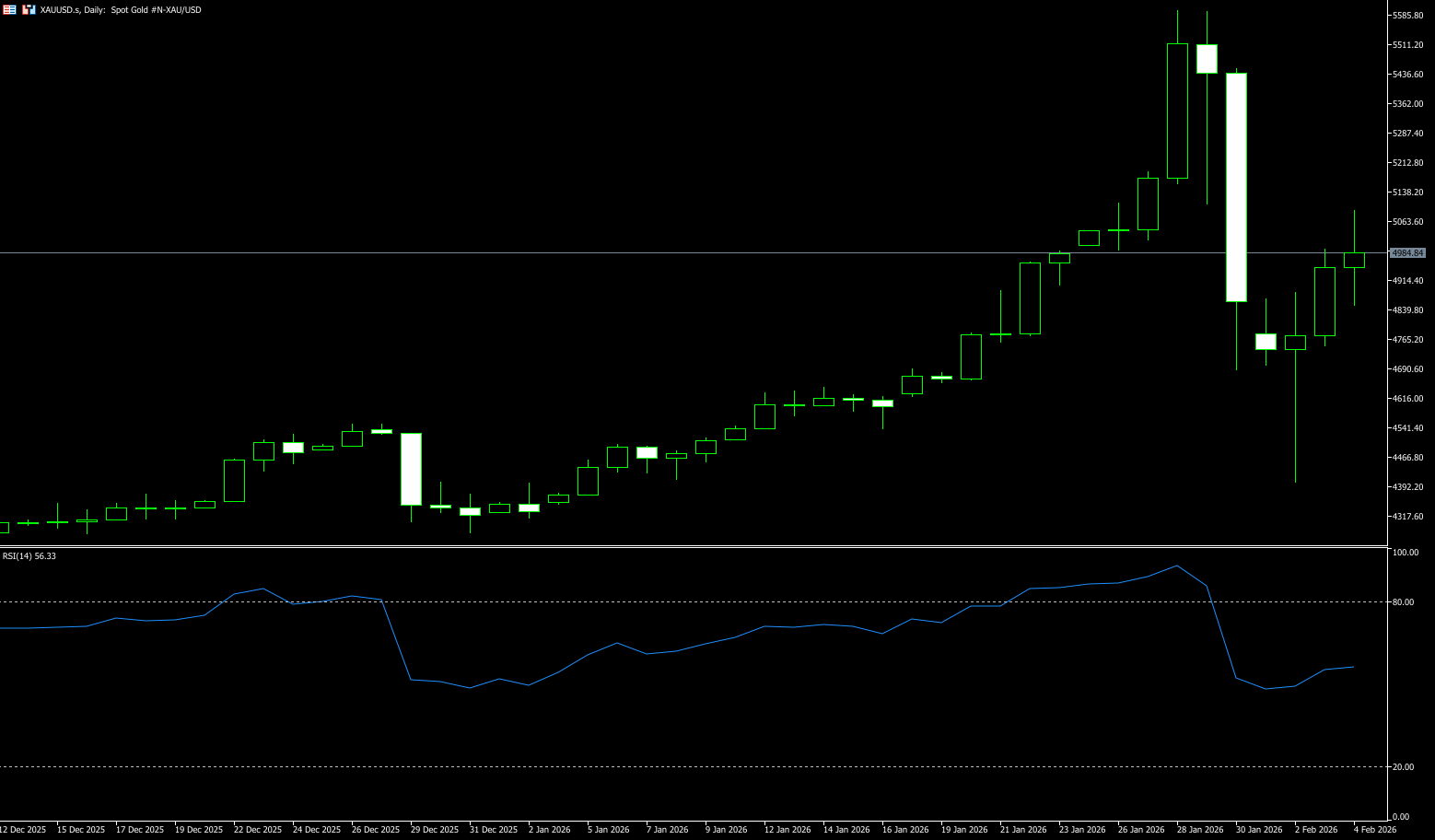

Spot Gold

Gold climbed back above the key $5,000 per ounce level on Wednesday, marking its biggest one-day gain since 2008 after rising more than 6% in the previous session, as buyers rushed in after a sharp pullback earlier in the week. Geopolitical tensions also boosted the metal's safe-haven appeal after the US military shot down an Iranian drone near the Arabian Sea, despite President Trump stating that diplomacy was still active and the White House confirming that US-Iran talks were still scheduled for Friday. Meanwhile, market expectations for rapid interest rate cuts by the Fed have diminished after Trump nominated Kevin Warsh to be the Fed chairman, although the market still expects two rate cuts this year, possibly in the middle of the year and later in 2026.

The daily chart shows spot gold back above $5,000, having previously risen to $5.050. This week's overall trend is "oversold rebound + high-level fluctuation". The short-term bullish recovery signal is clear, but the selling pressure at high levels and the risk of overbought conditions are gradually emerging. It is likely that the pattern of switching between strong and weak forces and increased volatility within the range will continue. After the sharp drop at the beginning of the month, a rapid V-shaped rebound occurred. The large positive candle broke through the 5-day and 10-day moving averages and turned upward, indicating a clear short-term bullish recovery signal. The price is still below the 20-day moving average, and the medium-term trend needs to be confirmed. The MACD has formed a golden cross at a low level, and the red bars continue to expand, indicating that the bearish momentum has weakened and the rebound trend has been established. The RSI (14) has quickly rebounded from the oversold zone to around 58. It is expected that the price will fluctuate and consolidate at high levels in the latter half of this week, with a range of 4,831 {20-day moving average} – 5,5110 {January 26 high}. Unless gold prices break below the $4,944 (14-day moving average) and $4,900 (psychological level) area, this could exacerbate the pressure on the 20-day moving average at $4,831, followed by the $4,800 (psychological level).

Consider going long on gold today near $4,958; Stop loss: $4,950; Target: $5,030; $5,050

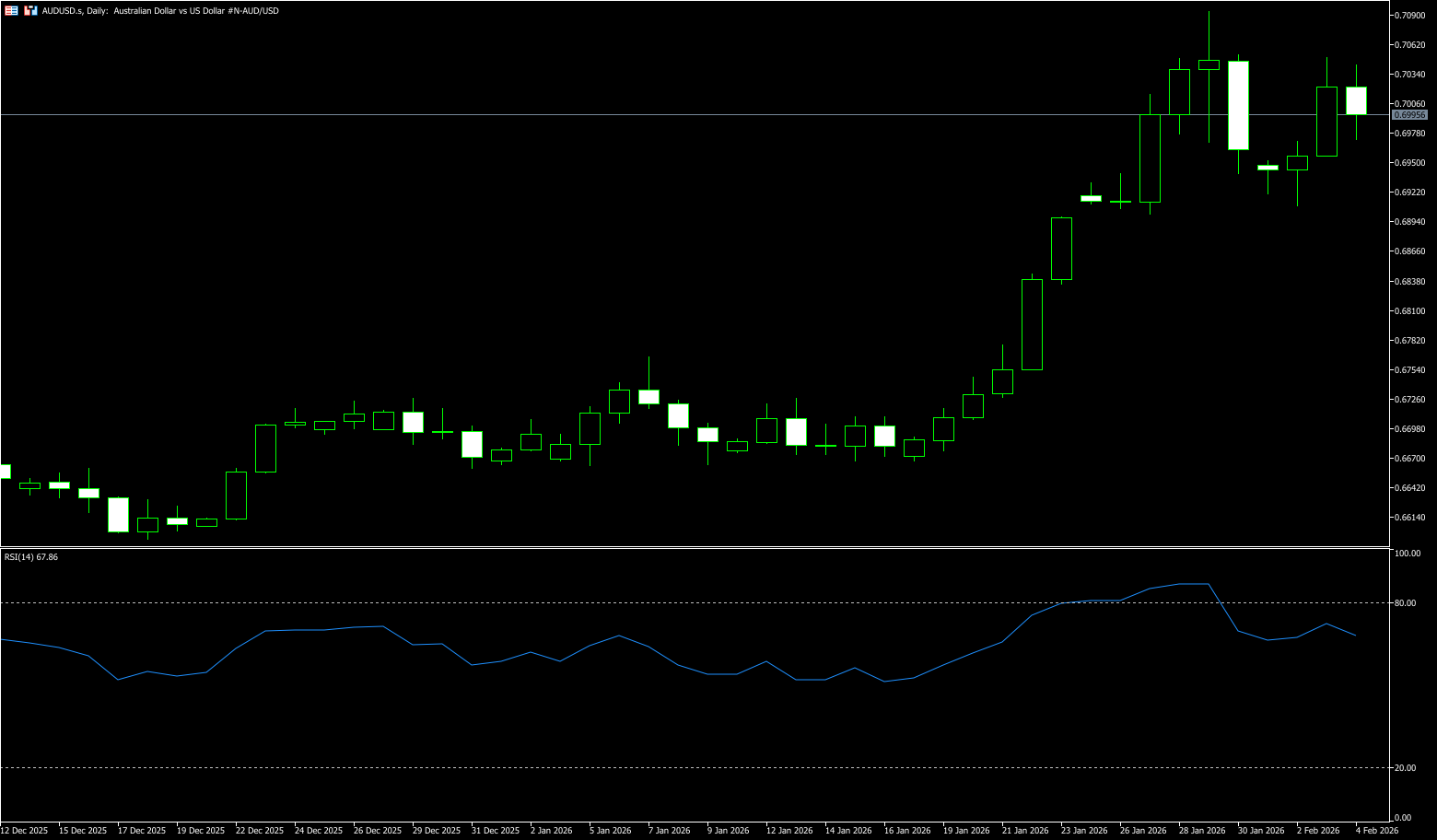

AUD/USD

The Australian dollar extended its rally from the previous session, driven by hawkish policy, and rose to a three-year high on the third week, above $0.7000, as the market bet on more rate hikes, supported by an optimistic services PMI. The Reserve Bank of Australia raised the cash rate for the first time in two years at its February meeting, citing strong economic growth and a continued inflation outlook. With the central bank entering a rate hike cycle, investors have increased their bets on a May rate hike to 80% and anticipate an additional tightening of around 40 basis points by 2026. While the Reserve Bank of Australia's base case only suggests one more rate hike, high inflation risks could prompt additional increases. Recent data shows that Australia's service sector expansion has reached its highest level in nearly four years, further highlighting the continued economic upswing.

The Australian dollar traded near 0.7000 against the US dollar on Wednesday. Daily chart analysis suggests the pair remains in an ascending channel pattern, indicating a continued bullish bias. The 14-day Relative Strength Index (RSI) is at 71.00; generally indicating bullish momentum, but the momentum has stretched. The Australian dollar rebounded to 0.7094 against the US dollar, its highest level since February 2023, a level previously reached on January 29. A break above this level would support the pair testing the February 2023 high of 0.7158. On the downside, key support lies at the 10-day simple moving average (SMA) at 0.6969. A break below this level would lead to further declines and expose the support zone at 0.6900 (psychological level) and 0.6899 (14-day SMA).

Consider going long on the Australian dollar today near 0.6990; Stop loss: 0.6980; Target: 0.7040; 0.7050

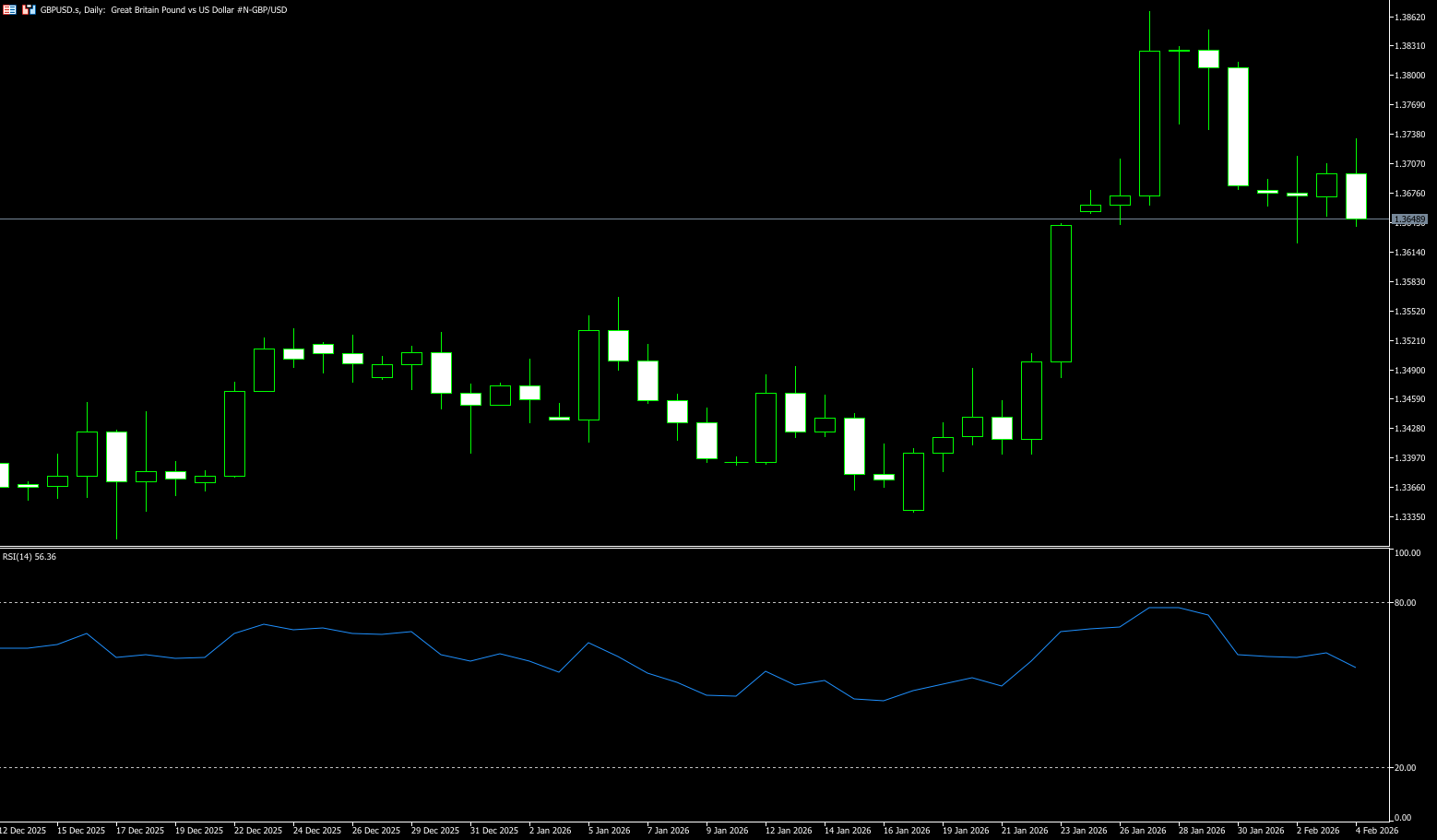

GBP/USD

The pound depreciated to around $1.3655, further below the high of $1.3847 reached on August 27, 2021, as investors adopted a cautious stance ahead of the Bank of England's policy decision. The market widely expects the Bank of England to maintain interest rates at 3.75% this week. Looking ahead, expectations for rate cuts have been reduced, with investors anticipating less than a 50% chance of more than one rate cut this year, reflecting the resilience of UK economic data and persistently high inflation. The UK's inflation remains the highest among the G7 countries, and recent manufacturing purchasing managers' index data showed activity levels reaching their highest point since August 2024, further supporting the argument for policy patience. However, the pound is under pressure from a stronger dollar due to changes in expectations from Federal Reserve leadership and reduced bets on US rate cuts.

This week is likely to see a continuation of the oscillating but slightly bullish trend. The key focus will be on whether the 1.3700-1.3750 resistance level and the 1.3650-1.3600 support level will be broken. The Bank of England's policy decision and the US non-farm payrolls data will be key catalysts. The daily RSI indicator is in the 50-55 range, far from overbought, indicating a moderate release of bullish momentum with no obvious signs of exhaustion. The MACD maintains a golden cross, with the red bars slightly expanding, showing that bullish strength is slowly accumulating, but upward momentum remains insufficient. If the pair closes above 1.3700 this week, it will lay the foundation for a further upward move towards the 1.3750-1.3800 range; if it falls below 1.3650, it may return to the 1.3600-1.3580 range. Pay close attention to the Bank of England's decision and the US non-farm payroll data. If a clear fundamental catalyst emerges, adjust positions accordingly and follow the trend.

Today, consider going long on the pound near 1.3640; stop loss: 1.3630; target: 1.3700; 1.3710

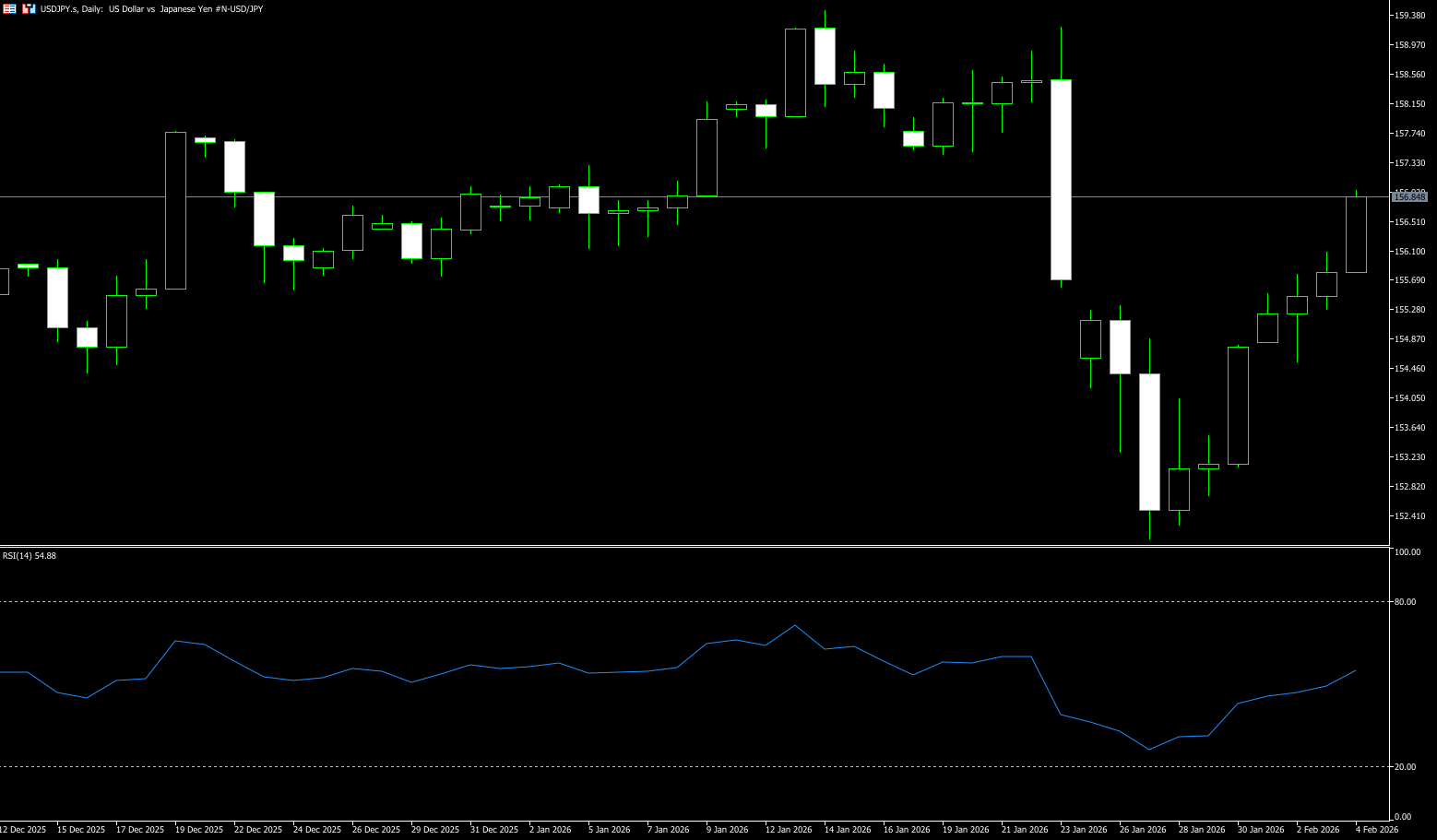

USD/JPY

The yen depreciated by more than $156.70 on Wednesday, falling for the fourth consecutive trading day and approaching a two-week low, due to the upcoming surprise House of Representatives election this weekend. Prime Minister Sanae Takaichi's ruling Liberal Democratic Party is expected to gain more seats in the national election as she seeks voter support for increased spending, tax cuts, and a new security strategy. Since Takashi's election, Japanese bonds and the yen have come under pressure as she pushes for expansionary fiscal policies, raising concerns about Japan's fiscal outlook and debt financing spending. Takashi also stated over the weekend that a weaker yen could be an opportunity for the export sector, but later retracted those comments, clarifying that her remarks were intended to promote an economy resilient to currency fluctuations. The yen rose 4.5% in late January amid speculation of coordinated US-Japan intervention in the currency market, but has since retraced more than half of those gains.

The USD/JPY pair extended its winning streak, rising above 156 for the third consecutive trading day, driven by continued strength in the US dollar. Technically, after correcting to the middle band, USD/JPY rebounded rapidly around Takashi's highs, with the Nikkei 225 also hitting a new all-time high. Support is around 155.30 (Tuesday's low), a break below which would test the 154.95 level (10-day simple moving average). If the exchange rate retraces to near the 154.95-155.00 area, it is highly likely to trigger further upward movement, with resistance at 157.00 (a psychological level). Then comes 157.74 (the high from last December).

Today, consider shorting the US dollar near 157.10; Stop loss: 157.30; Target: 156.20; 156.00

EUR/USD

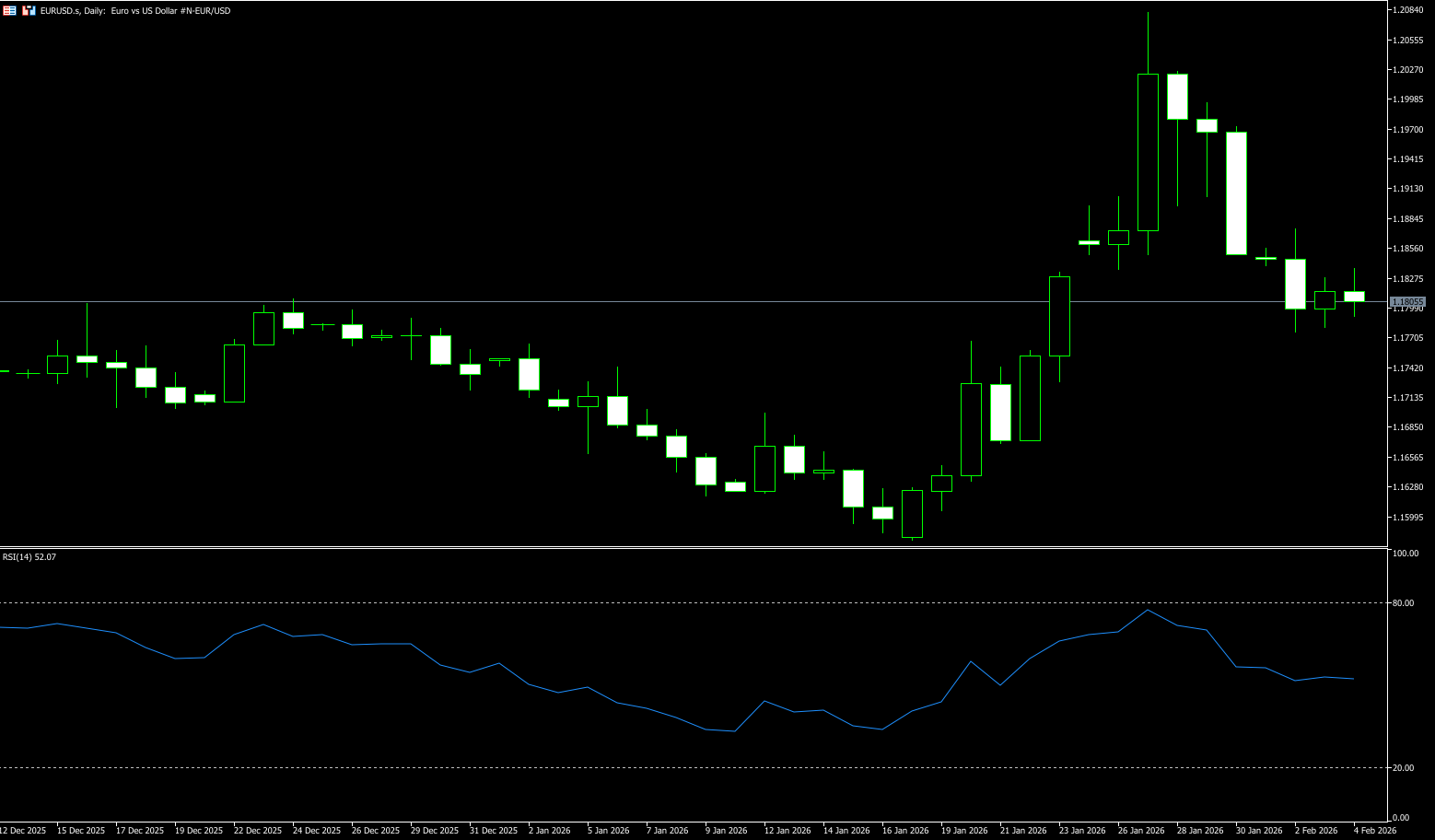

The EUR/USD pair struggled to capitalize on the previous day's modest rebound from the 1.1780-1.1775 area, or a one-week low, during Wednesday's Asian session, and traded within a narrow range. The spot price is currently trading around 1.1810, with little change throughout the day. Market focus remains on Thursday's highly anticipated ECB policy meeting. The outcome will play a crucial role in the short-term movement of the EUR/USD pair. Meanwhile, a slight deterioration in global risk sentiment has provided some support for the safe-haven US dollar and is acting as resistance for the pair. In other words, the market's growing acceptance of the expectation that the Federal Reserve will cut interest rates twice more in 2026 may limit the dollar's rise and support the EUR/USD pair. This warrants caution before the EUR/USD pair pulls back from its highest level since June 2021 reached last week.

The EUR/USD pair is likely to remain range-bound between 1.1780 and 1.1900 this week. While the weekly bullish base remains intact, short-term momentum is weakening. Daily indicators show increased divergence, leading to volatility. The key levels to watch are the 1.18 level and fundamental catalysts. The daily chart shows the MACD histogram shortening and the KDJ turning downwards from a high level, signaling a short-term pullback; the RSI remains between 55-60, retaining slight bullish resilience. The 21-day moving average provides short-term support, with the price repeatedly testing the 1.18 level. The divergence among indicators is causing increased short-term volatility, with the core focus on the 1.1800-1.1900 range. If the price can hold above 1.1830 and break through 1.1880 with significant volume, the probability of a bullish move to the 1.1900 level increases. Conversely, a break below 1.1780 could lead to a test of the 20-day simple moving average at 1.1758. The next key support level is at 1.1700 (a psychological level).

Today, consider going long on the Euro near 1.1800; stop loss: 1.1788; targets: 1.1850, 1.1860.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.

BCR Co Pty Ltd (Company No. 1975046) is a company incorporated under the laws of the British Virgin Islands, with its registered office at Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, and is licensed and regulated by the British Virgin Islands Financial Services Commission under License No. SIBA/L/19/1122.

Open Bridge Limited (Company No. 16701394) is a company incorporated under the Companies Act 2006 and registered in England and Wales, with its registered address at Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. This entity acts solely as a payment processor and does not provide any trading or investment services.