0

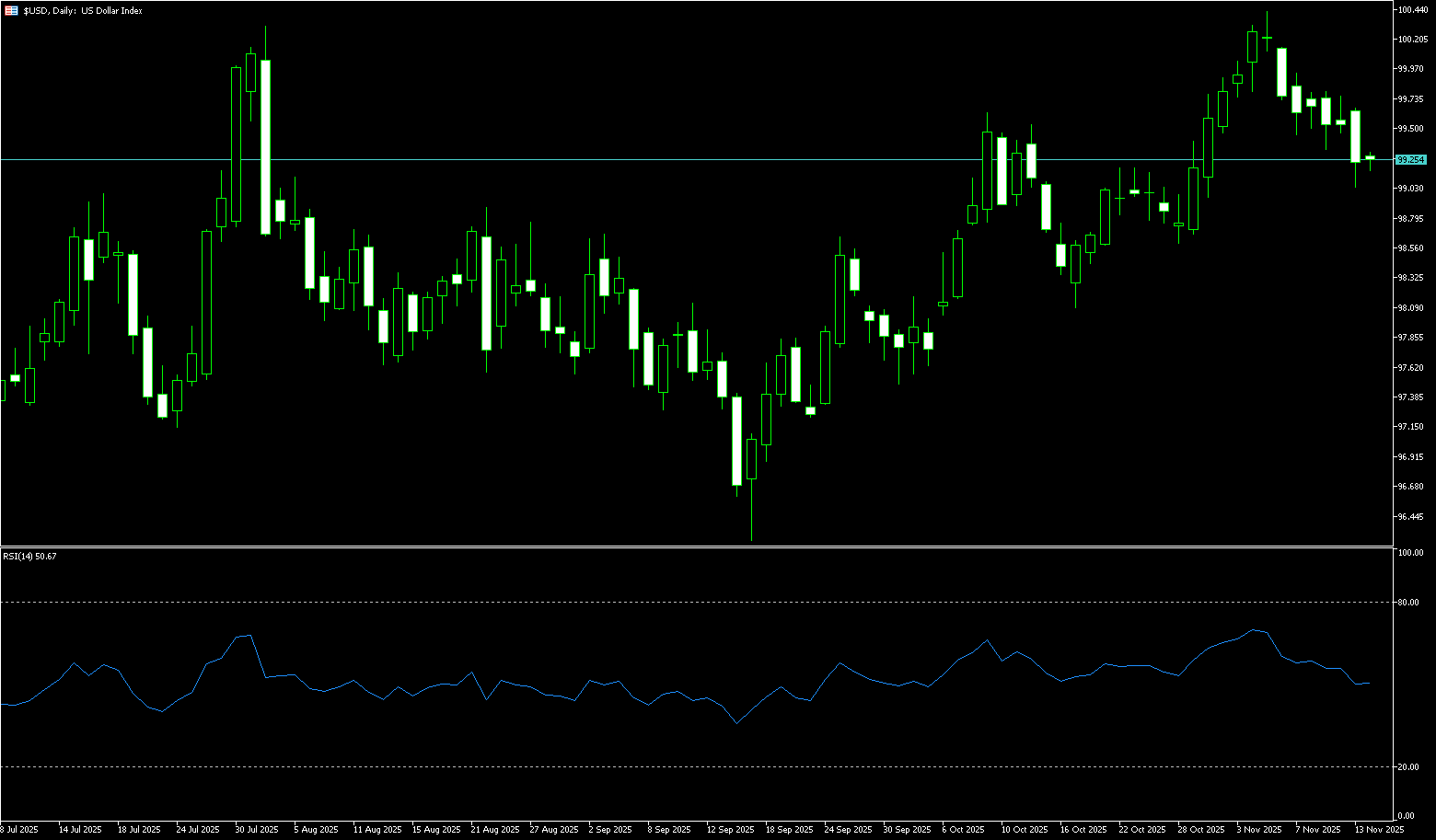

US Dollar Index

The US dollar index fell below 100 on Tuesday, amid expectations of a December rate cut by the Federal Reserve. Market confidence was strengthened after Federal Reserve President Christopher Waller signaled support for a rate cut following comments from New York Fed President John Williams and San Francisco Fed President Mary Daly. With the US government shutdown delaying key economic reports, markets are relying on older data, and the money market currently rates a rate cut in over 80% of cases. Recent data shows weakening consumer activity: retail sales rose only 0.2% in September, compared to a faster increase in August, indicating cooling spending. Wholesale inflation picked up, with the producer price index rising 0.3%, driven by energy and food costs. Investors are now focused on September durable goods data and Wednesday's jobless claims data.

Falling long-term Treasury yields coupled with thin market liquidity constrained the dollar's ability to build upward momentum. The dollar failed to receive support typically provided by strong yields or positive data, as investors were reluctant to increase risk exposure ahead of the Thanksgiving holiday. Given factors such as softening yields, persistent expectations of a December rate cut, and insufficient market liquidity, the short-term outlook for the US dollar is bearish. Unless upcoming data prompts traders to increase dollar buying, the dollar index may face the risk of retesting support levels. The dollar index remains in strong territory above the 200-day simple moving average at 99.78, but the market is gradually pulling back towards this key support level: a break below 99.78 could lead to a further test of the 99.49 pivot point (November 19th low); on the upside, resistance lies at 100.40 (last week's high), a break above which would pave the way for a move towards 100.58 (May 20th high).

Today, consider shorting the US Dollar Index around 99.94; Stop loss: 100.05; Target: 99.55; 99.45

WTI Crude Oil

WTI crude oil traded around $58.00 per barrel on Tuesday. Market expectations of a possible December rate cut by the Federal Reserve boosted risk assets, while investor caution regarding Russia's ability to reach a peace agreement with Ukraine to boost its oil exports limited the price decline. On the other hand, the prospect of a Russia-Ukraine peace agreement continued to dominate market sentiment. Reports indicate that the 28-point peace plan proposed by the US to end the war in Ukraine has been reduced to 19 points after discussions in Switzerland to make the framework more acceptable to Ukraine, although it is unclear which points were removed. An agreement could lead to the easing of sanctions on Russian oil, potentially providing additional supply to a market already prepared for a significant oversupply next year. WTI crude oil rose more than 1% on Monday, supported by a broad rally in financial markets as expectations grew that the Federal Reserve might cut rates next month.

The current weakness in oil prices is more driven by expectations than by direct changes in actual supply and demand. Uncertainty surrounding peace negotiations, the possibility of sanctions easing, and adjustments in Asian purchasing flows have put the market in a highly sensitive phase. Without new demand-side stimulus, oil prices may continue their moderate downward trend, but any changes in supply expectations could amplify short-term volatility. The daily chart shows WTI remains in a weak, oscillating pattern, with significant resistance from short-term moving averages. The 14-day RSI is in a neutral-to-weak range, indicating limited buying momentum. The candlestick pattern shows consecutive small-bodied fluctuations, reflecting market uncertainty regarding future negotiations and supply news. If oil prices continue to be constrained by the resistance zones above $59.60 (the 20-day simple moving average) and $60.00 (the psychological level), as well as $60.82 (the high of November 18th), prices may fall back to around $57.33 (last week's low) and the $56.00 level.

Today, consider going long on crude oil around 57.65; Stop loss: 57.45; Target: 59.00; 59.30

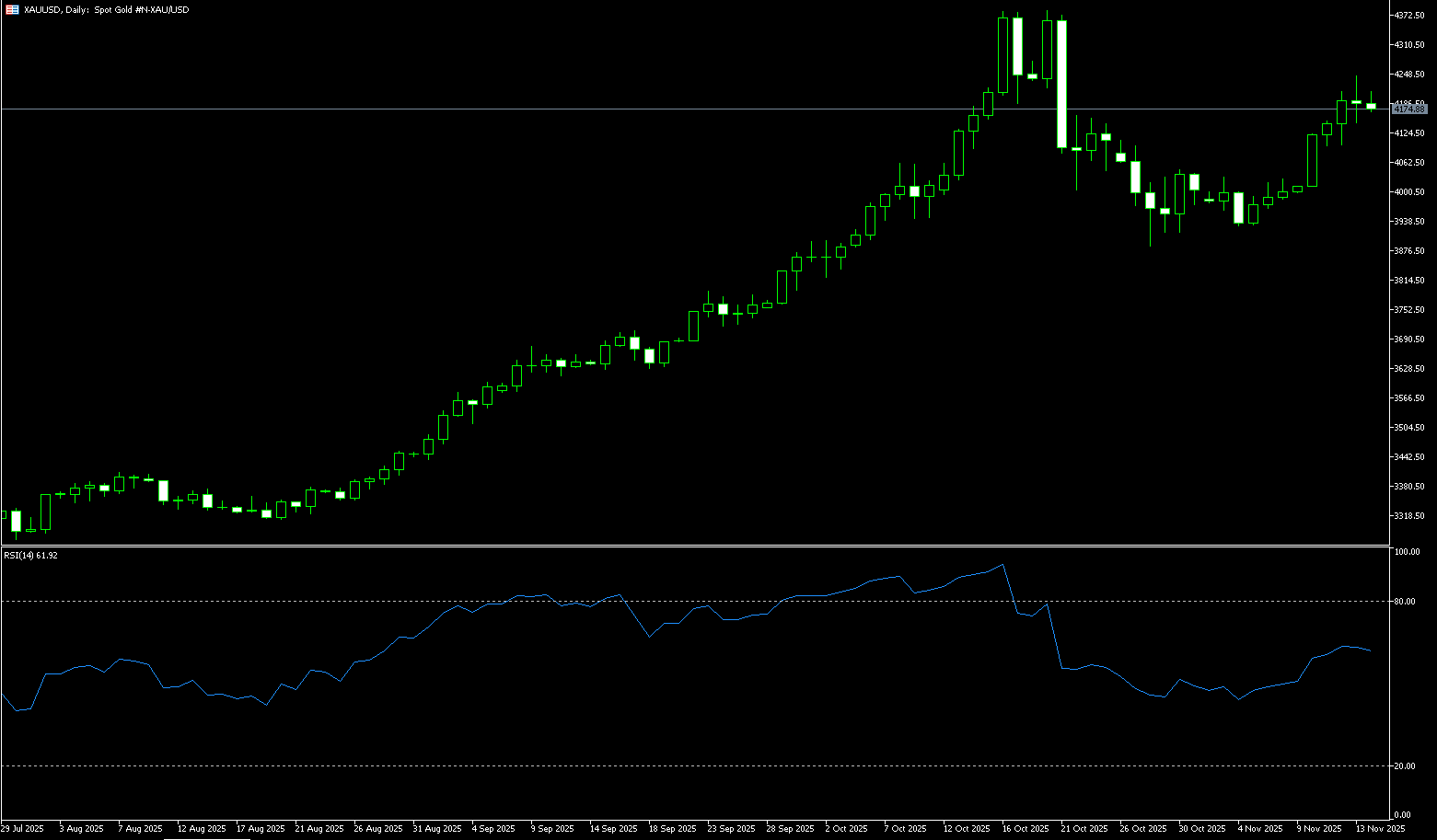

Spot Gold

Gold prices hovered around $4,130 per ounce on Tuesday, rising nearly 2% on Monday after dovish signals from Federal Reserve officials increased market expectations for a US rate cut next month. Fed Governor Christopher Waller reiterated his support for a December rate cut on Monday, citing continued weakness in the US labor market. Similarly, New York Fed President John Williams said on Friday that a rate cut in the near term remains possible. The market now rates 25 basis point cuts in December up to 81%, a significant increase from about 40% a week ago. Investors are now turning their attention to September retail sales and PPI data to be released later today, as well as weekly jobless claims data on Wednesday, for further insight into the state of the US economy and the possible path of Fed policy.

The situation in Russia and Ukraine has deteriorated sharply, with air raid sirens sounding in Kyiv, further hindering the peace process and triggering a strong return of safe-haven buying. With two positive factors converging, gold bulls have fully seized the initiative. The main upward wave is targeting the $4,200-$4,300 range! For investors, the question now is not "Should I buy gold?", but "Is it still possible to get on board?" The second wave of the super bull market for gold seems to have arrived in full force! Technically, spot gold has successfully broken through and stabilized above the $4,100 psychological level. Short-term moving averages are in a bullish alignment, the MACD fast and slow lines are showing a golden cross trend, and the 14-day RSI has entered above 58 but has not yet shown a bearish divergence, indicating that the upward momentum remains strong. If the expectation of a Fed rate cut continues to ferment and is coupled with geopolitical risks, the probability of breaking through $4,200 and even challenging the historical high of $4,300 is rapidly increasing. On the downside, pay attention to the $4,100 psychological level; a break above this level would target the $4,059 level (the 20-day simple moving average).

Consider going long on gold around 4,124 today; Stop loss: 4,120; Target: 4,150; 4,160

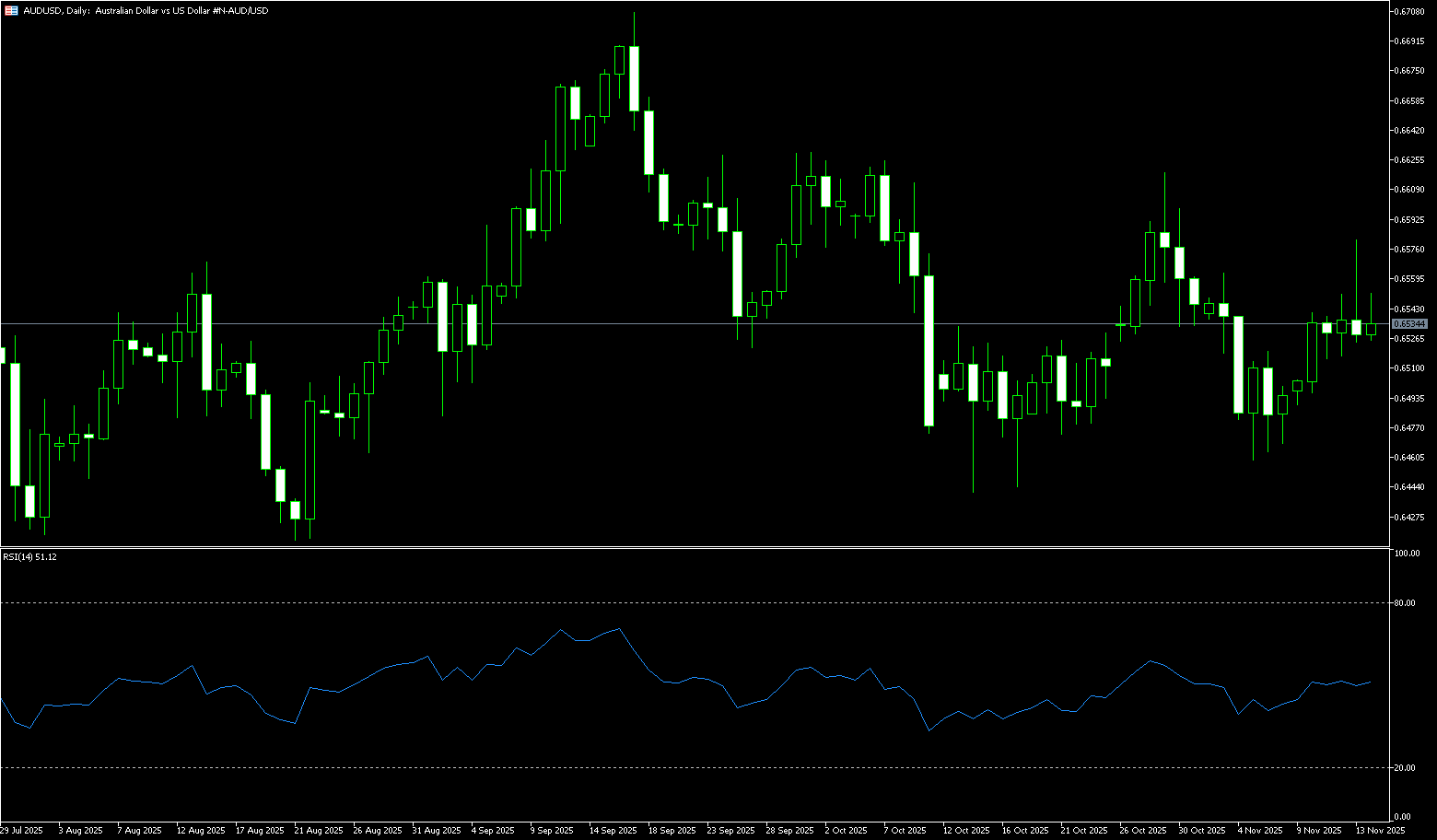

AUD/USD

On Tuesday, the Australian dollar stabilized around US$0.6470 as the market assessed the ongoing debate within the Reserve Bank of Australia (RBA) regarding the tightness of monetary policy. Comments from Deputy Governor Sarah Hunter highlighted that the central bank is reassessing three key changes in the economy, including how businesses are pricing post-pandemic, how tight the labor market remains, and changes in policy transmission given the stronger-than-expected housing market response. Meanwhile, improved PMI data in November, with the composite output index expanding for the 14th consecutive month, indicates signs of economic strengthening. These data, combined with improved business surveys, stronger consumer confidence, a declining unemployment rate, and a surging housing market, reduce the likelihood of further interest rate cuts by the RBA. Focus now shifts to Wednesday's CPI data, the first comprehensive monthly price data release, with annual inflation expected to remain at 3.6%.

The AUD/USD pair continues to trade at the lower end of its range, testing its key 200-day simple moving average at 0.6461 under sustained downward pressure. Furthermore, momentum indicators support further pullbacks in the short term: the Relative Strength Index (RSI) hovers around 40, while the Average Directional Index (ADX) is around 14, suggesting the current trend remains weak. A sustained break above the 0.6461 200-day simple moving average could open the door to 0.6421 (the November 23 low) and potentially further towards the psychological level of 0.6400. On the other hand, there are temporary obstacles at 0.6485 (the 9-day simple moving average) and 0.6500 (a psychological level), followed by the November high of 0.6536 (the 50-day simple moving average) and 0.6551 (the area around the November 14 high).

Consider going long on the Australian dollar around 0.6460 today; Stop loss: 0.6450; Target: 0.6510; 0.6530

GBP/USD

After three consecutive days of gains, GBP/USD continued its upward trend, trading around 1.3160 during Tuesday's European session. The yield on 10-year UK government bonds slipped slightly to 4.54%, as investors awaited the budget on November 26th. Chancellor Rachel Reeves is expected to raise tens of billions of pounds to meet fiscal rules, while the Office for Fiscal Responsibility is preparing to lower its growth and productivity forecasts. The pound's movement is further influenced by moderate inflation, with the October inflation rate falling to 3.6%, strengthening market expectations for a Bank of England rate cut. Despite growing market expectations for a December rate cut by the Federal Reserve (driven by recent dovish comments from Fed policymakers), the rebound of GBP/USD against the dollar remains weak.

If GBP/USD breaks above the overnight high (around 1.3120-1.3125), it may face resistance in the 1.3155-1.3160 area or the top of the weekly trading range. However, a sustained break above this area would pave the way for a recovery to the 1.3200 psychological level. Some buying on the rally could push GBP/USD above the technically important 200-day simple moving average resistance level around 1.3303. On the other hand, the 1.3040-1.3035 area (the overnight low) may provide immediate support before the psychological level of 1.3000. A decisive break below this area would likely lead to further downside for GBP/USD, eventually breaking below the next relevant support level at 1.2950 and potentially falling to 1.2900.

Consider going long on GBP/USD around 1.3150 today; Stop loss: 1.3140; Target: 1.3200; 1.3215

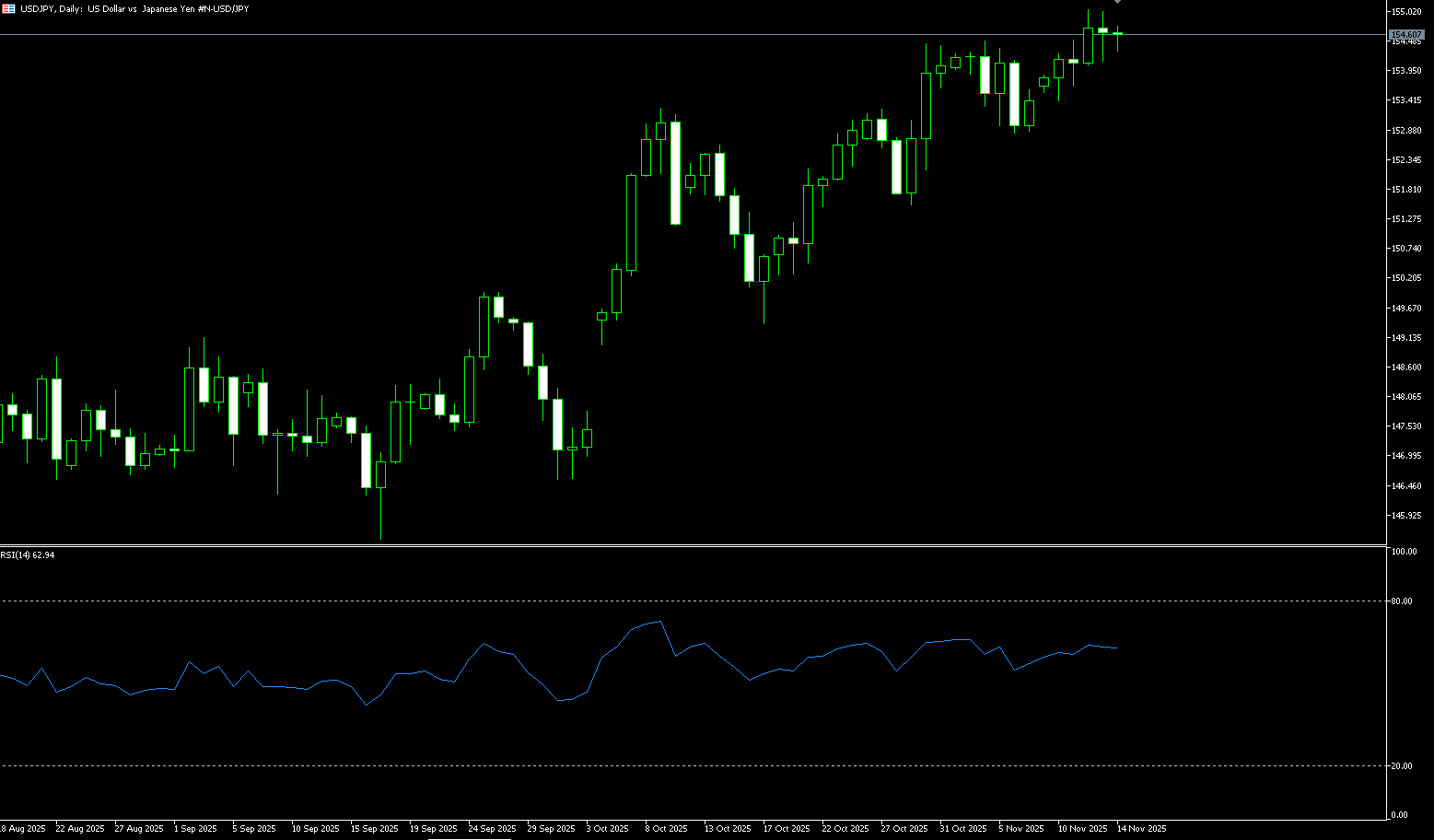

USD/JPY

The yen rose to around 156.0 yen per dollar on Tuesday, recovering from losses in the previous session, amid rumors that authorities might intervene to curb the yen's depreciation. On Sunday, Takuji Aida, an advisor to Japanese Prime Minister Sanae Takaichi, said Tokyo was prepared to actively intervene in the currency market to offset the negative economic impact of the yen's depreciation, echoing comments from Bank of Japan Governor Kazuo Ueda and Finance Minister Satsuki Katayama. Markets are watching the upcoming US holiday this week as a potential opportunity for Japanese intervention, as periods of low liquidity could amplify the impact. The yen has weakened since early October since Takaichi's election, as she introduced a fiscal package and expressed support for loose monetary policy.

From the 4-hour chart, USD/JPY has been trending upwards from around 153.70, forming a low of 153.61 before accelerating above 155.70, reaching a high of 157.89. It is currently consolidating around 156.00. The MACD histogram is gradually shortening at high levels, indicating a period of momentum recovery and directional choice. The RSI has fallen from the overbought zone around 80 to the neutral-to-upper 50-60 range, suggesting a shift from extreme optimism to relative equilibrium, with short-term buying interest cooling somewhat, but the bears' advantage is not yet significant. The 155.70 level has been repeatedly confirmed, indicating concentrated market activity in this area. If the exchange rate holds above this level and retests the 157.89 area, the upward trend could extend further to the psychological level of 160. Currently, it is in a phase of high-level consolidation and trend divergence; the outcome of the consolidation between 156.50 and 156.00 will be crucial in guiding the future direction. A break below this level would target 155.00.

Consider shorting the US dollar today around 156.30; Stop loss: 156.50; Target: 155.20; 155.30

EUR/USD

The EUR/USD pair traded in a narrow range for the second consecutive day on Tuesday, lacking follow-through buying and remaining confined to the broader range of the previous day. The spot price is currently trading around the 1.15360-1.1570 area. Recent comments from Federal Reserve officials have increased market bets on another rate cut in December, causing the dollar to fall below its highest level since the end of May and providing a boost to the EUR/USD pair. New York Fed President John Williams stated that current policy is moderately restrictive and that the central bank could still cut rates in the short term. In addition, Fed Governor Christopher Waller said on Monday that current data shows the US job market remains weak enough to warrant another 25 basis point rate cut at the December policy meeting. Traders reacted quickly, now anticipating an approximately 80% chance of the Federal Reserve lowering borrowing costs next month, which, along with a generally positive risk tone, has weakened the price of safe-haven currencies.

Despite occasional strong performances, the euro remains under continued pressure against the dollar, and the possibility of further weakness remains. Furthermore, momentum indicators currently still point to further declines. However, the Relative Strength Index (RSI) is gradually approaching the 47 level, while the Average Directional Movement Index (ADX) below 15 suggests the trend remains weak. Indeed, a break below the support level of 1.1468 (November 5th), the November low, could pave the way for a move towards the key 200-day moving average of 1.1411 (which continues to support the August low of 1.1391, i.e., August 1st). Below that, the low of 1.1347 (June 2nd) has emerged. On the other hand, the 34-day simple moving average at 1.1584 is the first support level, followed by the psychological level of 1.1600, and then the 1.1650 level.

Today, consider going long on the Euro around 1.1560; Stop loss: 1.1550; Target: 1.1620; 1.1630

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Lebih Liputan

Pendedahan Risiko:Instrumen derivatif diniagakan di luar bursa dengan margin, yang bermakna ia membawa tahap risiko yang tinggi dan terdapat kemungkinan anda boleh kehilangan seluruh pelaburan anda. Produk-produk ini tidak sesuai untuk semua pelabur. Pastikan anda memahami sepenuhnya risiko dan pertimbangkan dengan teliti keadaan kewangan dan pengalaman dagangan anda sebelum berdagang. Cari nasihat kewangan bebas jika perlu sebelum membuka akaun dengan BCR.

BCR Co Pty Ltd (No. Syarikat 1975046) ialah syarikat yang diperbadankan di bawah undang-undang British Virgin Islands, dengan pejabat berdaftar di Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, dan dilesenkan serta dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan British Virgin Islands di bawah Lesen No. SIBA/L/19/1122.

Open Bridge Limited (No. Syarikat 16701394) ialah syarikat yang diperbadankan di bawah Akta Syarikat 2006 dan berdaftar di England dan Wales, dengan alamat berdaftar di Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. Entiti ini bertindak semata-mata sebagai pemproses pembayaran dan tidak menyediakan sebarang perkhidmatan perdagangan atau pelaburan.