0

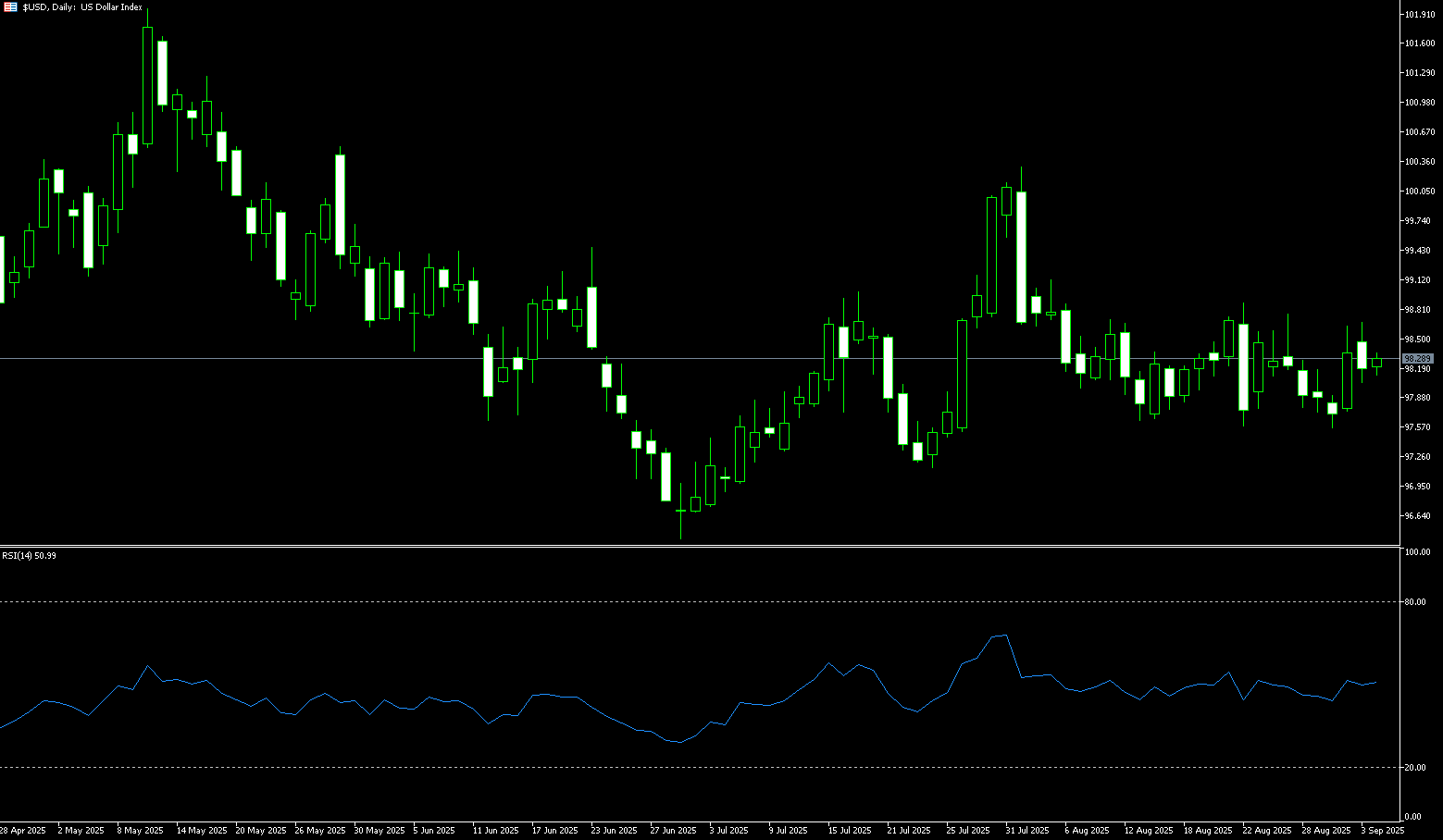

US Dollar Index

The US dollar index fell below 97.00 to 96.55 during Tuesday's European and Asian trading hours. This is its lowest level in over two months. The US dollar continued to face selling pressure as the Federal Reserve widely expected to initiate monetary easing in its policy statement on Wednesday. Traders fully anticipated a rate cut by the Fed on Wednesday. A Fed rate cut would be negative for the US dollar. With the Fed firmly anticipating a rate cut, investors will closely monitor the monetary policy statement and Chairman Powell's press conference for clues about possible interest rate moves for the rest of the year. This move is not isolated, but is closely intertwined with tightening liquidity in the US Treasury market, with the US Treasury yield curve moving up sharply on the short end. This capital outflow directly amplifies the dollar's safe-haven properties, but also limits upward momentum as the market prices in the Fed's policy shift.

The US dollar index remains technically bearish. The Relative Strength Index (RSI) on the daily chart (38.50) and the 8-hour chart (33.20) remain below 50, indicating that a rebound may be met with selling pressure. Recent price action has shown a downward trending channel since the August 5 high, supporting a bearish outlook. The recent rebound in the US dollar index has encountered resistance at 97.62 (the 9-day simple moving average), below the psychological 98.00 level. A break above 98.00 and the top of the channel (currently located in the 98.50 area) is needed to confirm a trend reversal. On the downside, immediate key support lies at 96.55 (the September 16 low). Further downside, the July 1 low, near 96.38, will be in focus.

Consider shorting the US dollar index at 96.80 today, with a stop-loss at 96.90 and targets at 96.30 or 96.20.

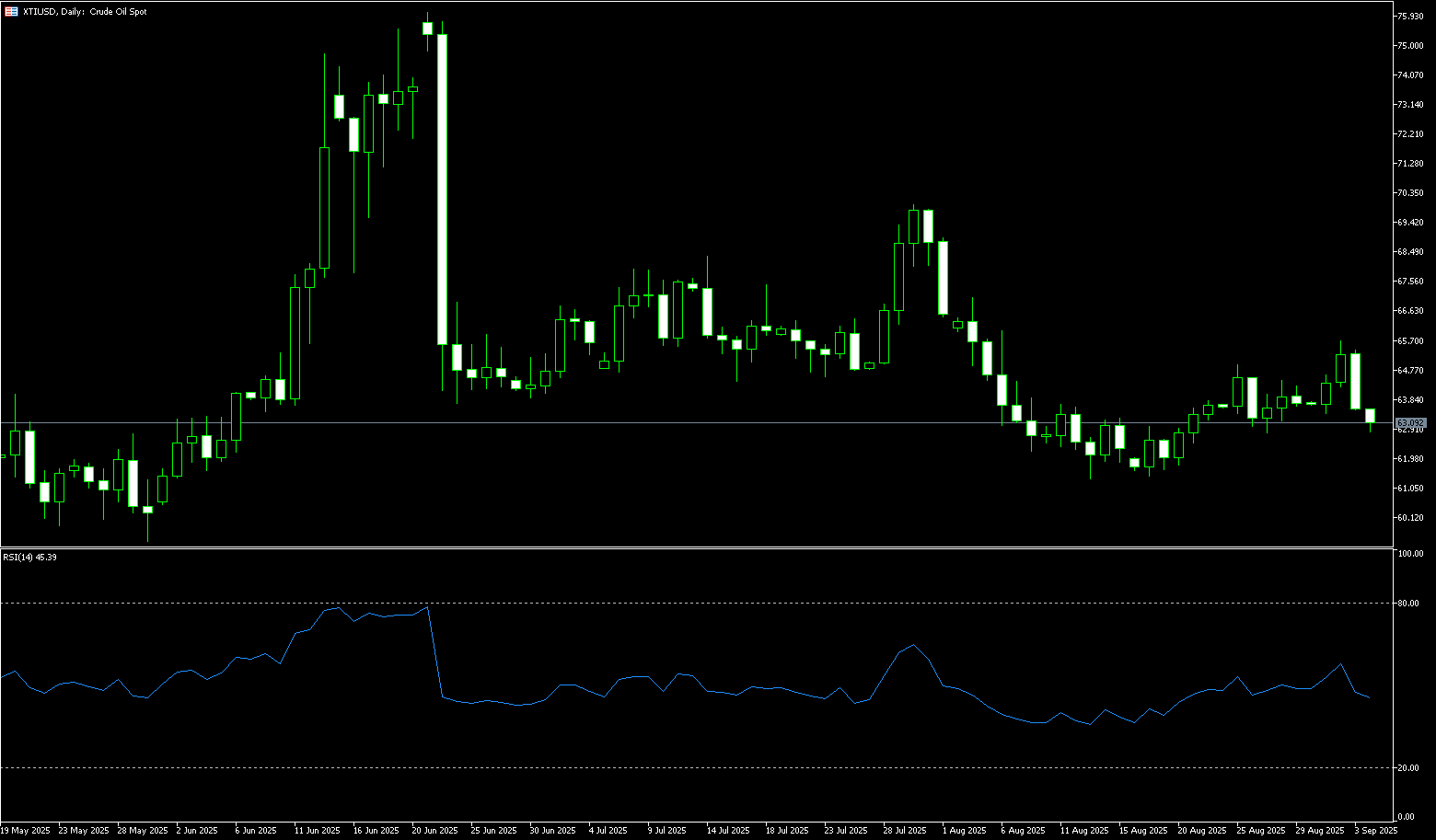

WTI Spot Crude Oil

WTI crude oil rose approximately 1.8% at the start of the week and is currently trading around 64.20. Oil prices remain volatile, supported by the moving average and the lower edge of the range. The current market is mired in uncertainty due to the US-Russia sanctions standoff and an oversupply of crude oil. However, rising expectations of a Federal Reserve rate cut (a 75 basis point cut is expected this year) have significantly boosted risk appetite. Stock market indices have reached new highs, and crude oil, despite pressure from moving averages and concerns about overproduction, has remained above its range, maintaining its upward trend. The crude oil market is projected to experience a significant surplus of 1.7 million barrels per day (mbd) in the fourth quarter of 2025, expanding to 2.4 million mbd in 2026, further exacerbating the supply-demand imbalance. In the current market environment, crude oil prices are expected to continue to benefit from the following core factors: continued geopolitical risks, the risk of supply disruptions caused by sanctions, and the expectation of easing Federal Reserve policy, which is supporting the overall risk-on tone in global markets.

The daily chart shows that given the complete formation within the triangle, if oil prices can hold above the resistance levels of $63.68 (35-day SMA) and $63.78 (last week's high), coupled with a surprise Fed rate cut, a bullish breakout is likely to occur, opening up upside potential to the following targets: $64.43 (50-day SMA) and $65.61 (50.0% Fibonacci retracement level from $70.02 to $61.20). However, traders should be wary of false breakouts to avoid buying expectations and selling reality. If oil prices fail to hold support at $62.62 (9-day SMA) due to OPEC+ increasing crude oil supply as planned, they could face a retest of $62.00 (round number), followed by $61.45 (September 12 low).

Consider going long on crude oil at 64.00 today. Stop-loss: 63.85, target: 65.30, 65.50.

Spot Gold

On Tuesday, spot gold prices held strong near $3,690 per ounce, reaching a stunning all-time high of $3,703 during the session. A weak US dollar index, declining US Treasury yields, and investors eagerly awaiting the Federal Reserve's policy meeting this week are all contributing to gold's upward momentum. With the Fed's two-day meeting set to begin on Tuesday, widely expected to be the first rate cut since December, gold's rally appears to have only just begun. Meanwhile, signals from the US Treasury market are also positive for gold. Investors are adjusting their positions by buying on the news and selling on confirmation. If the expected Fed rate cut materializes, inflation concerns could drive a slight rebound in the short term. This provides valuable breathing space for gold, leading to a surge in funds.

Judging from recent weekly trends, gold bulls hold a strong advantage overall on a near-term technical basis. The $3,700 level will be a key test in the short term. If the Federal Reserve delivers dovish signals at its meeting on Wednesday, gold prices could easily break through. Conversely, if political pressure leads to unexpectedly hawkish rhetoric, a brief pullback could be triggered. Technically, the 14-day Relative Strength Index (RSI) remains in overbought territory at 78.90, supporting the view that prices will continue to range-bound before the next leg of gains. A break above immediate resistance at $3,690.60 (Tuesday's high) could lead to a retest of the all-time high at $3,700 and further towards the $3.750 level. Meanwhile, the Asian trading session low of $3,627-3,626 could offer immediate support, followed by the $3,610-3,600 range. A sustained break below last week's low of $3,580 could lead to a further correction in gold prices towards the intermediate support range of $3,565-3,560.

Consider a long position in gold at $3,685 today, with a stop-loss at $3,680 and targets at $3,720 and $3,725.

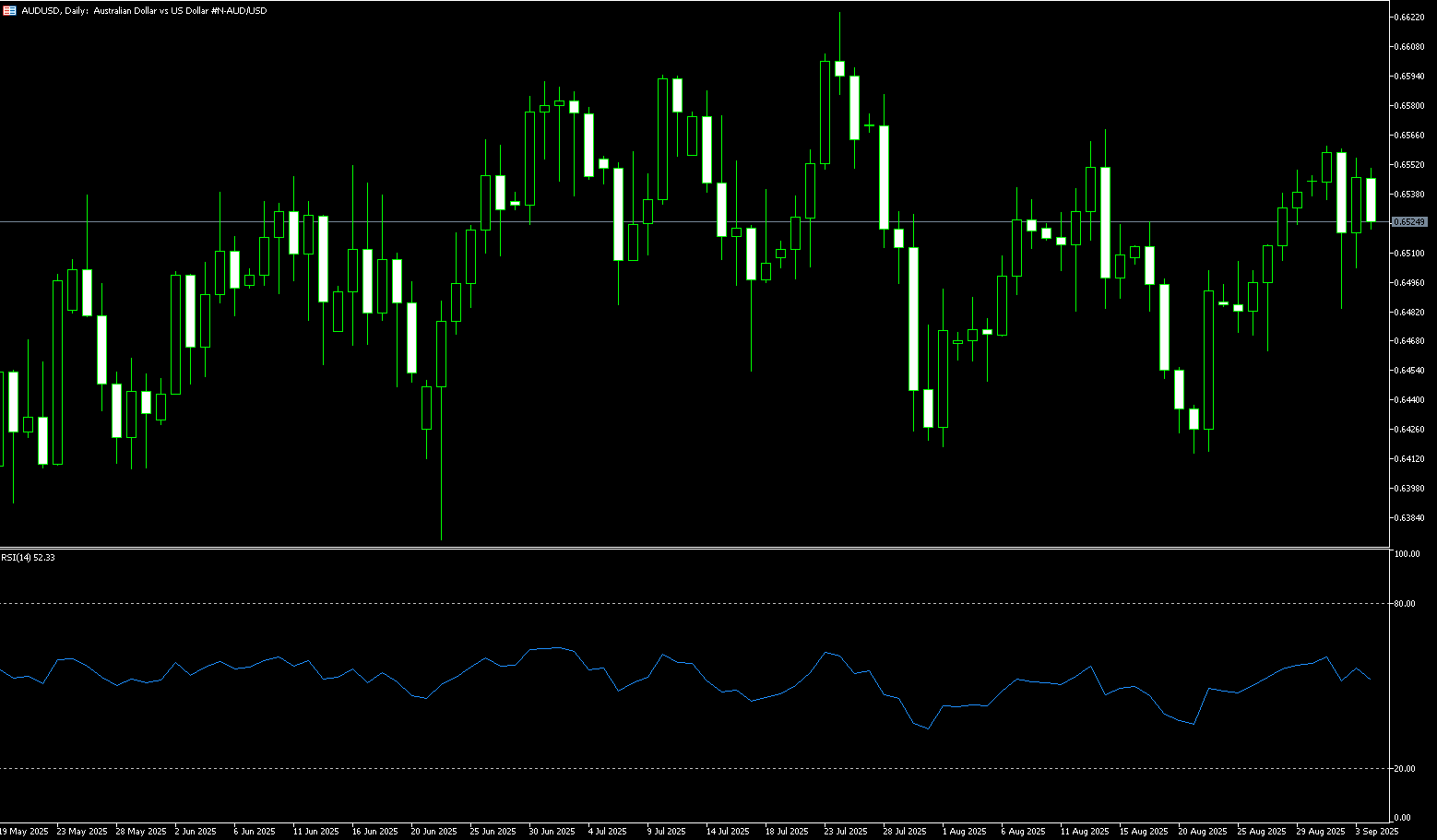

AUD/USD

The Australian dollar remained stable against the US dollar on Tuesday, following gains in the previous session. The pair appreciated as the US dollar came under pressure ahead of the upcoming US Federal Reserve policy meeting. Reserve Bank of Australia Assistant Governor Sarah Hunt stated on Tuesday that the central bank is "close to having inflation within its target range." Hunt noted that risks to the outlook are balanced and emphasized the need for a forward-looking approach given the lagged effects of monetary policy. She added that the Reserve Bank is closely monitoring the underlying strength of consumer spending and aims to keep the economy close to full employment. The Australian dollar found support as the likelihood of further RBA rate cuts diminished. Consumer inflation expectations also rose in September, indicating strong domestic demand and raising concerns about resurgent inflationary pressures.

AUD/USD traded around 0.6680 on Tuesday. Technical analysis on the daily chart shows the pair moving upward within an ascending channel pattern, indicating a bullish market bias. Furthermore, the pair is above its 9-day simple moving average at 0.6612, suggesting strong short-term price momentum. On the upside, the pair could target the 11-month high of 0.6687 reached in November 2024, followed by the upper boundary of the ascending channel, around 0.6700. The next target would be 0.6742 (the high of October 10, 2024). Initial support for AUD/USD is likely to be found at the 9-day simple moving average at 0.6612, followed by the psychological level of 0.6600. A break below 0.6600 would weaken short-term price momentum and lead the pair to test the 20-day simple moving average, around 0.6551.

Consider a long AUD at 0.6668 today, with a stop-loss at 0.6655 and targets at 0.6720 and 0.6730.

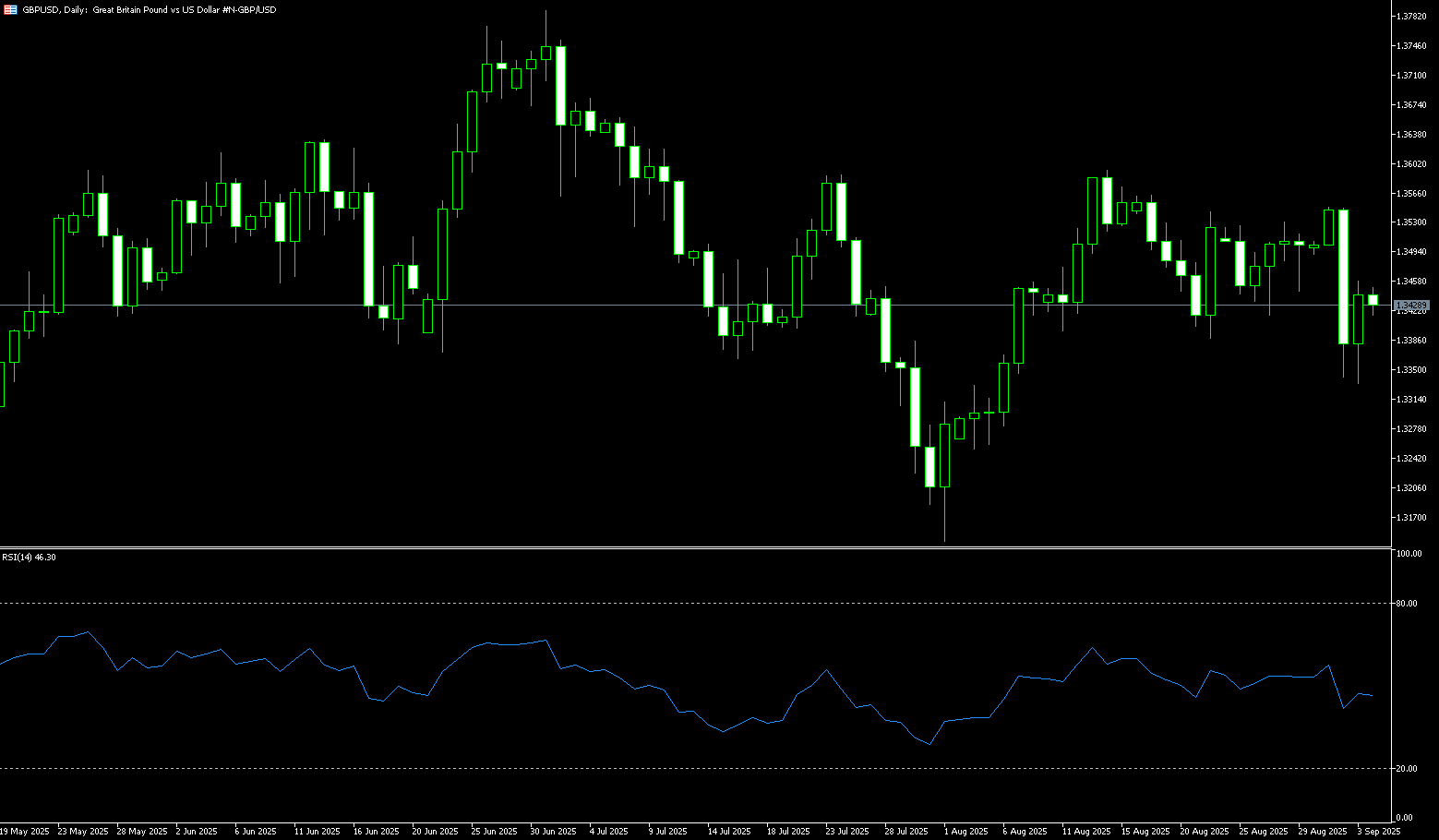

GBP/USD

The British pound rose above $1.3650, nearing a 10-week high, as markets await a busy week filled with central bank decisions and UK data. UK labor market data for the month ending July was released earlier this week. The Office for National Statistics (ONS) reported that the unemployment rate remained at a four-year high of 4.7%, as economists had expected. The Bank of England is expected to maintain its policy rate at 4% on Thursday and slow its £100 billion annual bond reduction. UK inflation data for August is expected on Wednesday and is projected to be 3.8% year-on-year, matching July's 18-month high. The employment report and retail sales data will be released later this week. Markets currently priced in a one-in-three chance of a Bank of England rate cut before December. Meanwhile, the Federal Reserve is expected to cut interest rates by 25 basis points on Wednesday, with traders anticipating at least two more rate cuts by the end of 2025.

Earlier this week, GBP/USD edged higher to a more than two-month high near 1.3650. With the exchange rate above the 5-day simple moving average at 1.3527, the short-term trend remains bullish. With GBP/USD breaking through the resistance high of the ascending triangle (around 1.3588), further bullish activity is clearly evident. Upward targets include the July 4 high of 1.3681 and the 1.3700 round number. A break below this level opens the door to 1.3788 (the July 1 high). Potential support lies below, with the 5-day simple moving average at 1.3527 and the 1.3500 round number. A move towards these levels could lead to resistance or support. The 14-day Relative Strength Index (RSI) is range-bound between 60 and 65, indicating that GBP/USD is currently in a relatively strong range, but has not yet entered overbought territory. In the short term, price action is likely to remain volatile and bullish.

Consider a long GBP at 1.3635 today, with a stop-loss at 1.3620 and targets at 1.3680 and 1.3690.

USD/JPY

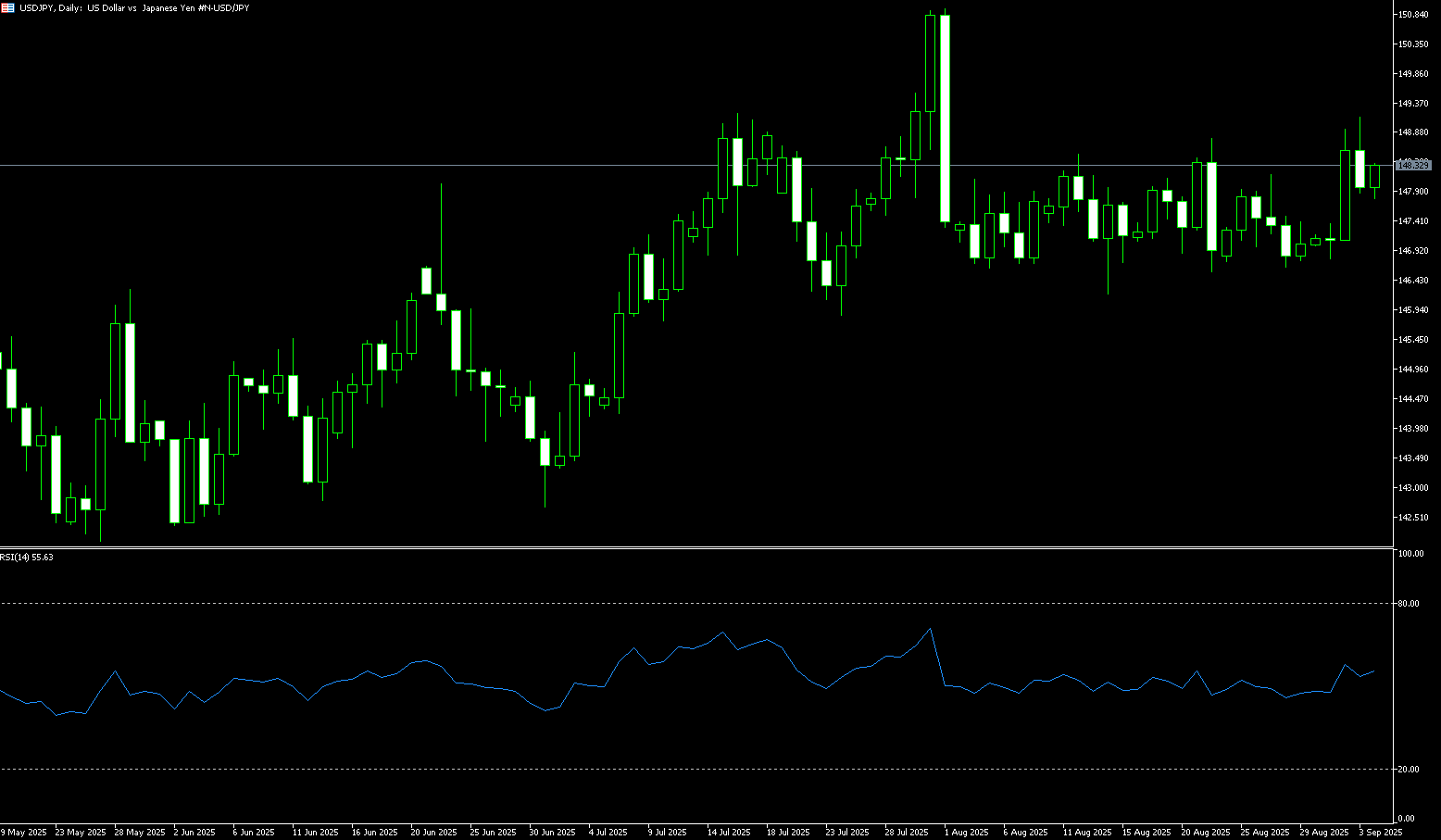

During Tuesday's Asian trading session, the Japanese yen continued its sideways trading around 146.50 amid a generally weaker US dollar, as traders awaited key central bank events this week. The Federal Reserve is scheduled to announce the results of its two-day meeting on Wednesday, followed by the Bank of Japan's key decision on Friday. Meanwhile, uncertainty regarding the timing and pace of the Bank of Japan's rate hikes, coupled with widespread risk appetite, provided headwinds for the safe-haven yen. However, any significant decline in the yen appears elusive as markets increasingly accept that the Bank of Japan will stick to its policy normalization path. This represents a significant divergence from the Federal Reserve's more aggressive easing bets, which have kept the dollar near its lowest level since July 24 and should help limit gains in USD/JPY.

USD/JPY's range-bound behavior may be seen as a consolidation phase before the next directional move. Meanwhile, recent failures at the technically important 200-day simple moving average near 148.72 suggest that USD/JPY's path of least resistance lies to the downside. That said, given the neutral oscillator on the daily chart, it remains prudent to await some follow-through selling and confirmation below the 147.00 level before positioning for a further decline. Spot prices could accelerate their decline toward the 146.00 round-number mark, below which the downward trajectory could extend further towards the intermediate support level of 145.35. On the other hand, any positive upward movement is likely to encounter immediate resistance near the 148.00 round-number mark, a break of which could trigger a short-term buying rally towards the 200-day simple moving average resistance at 148.72. Sustained follow-through buying could lead prices above the 149.00 level and the monthly high in the 149.15 region.

Consider shorting the US dollar at 146.72 today. Stop-loss: 146.95, target: 145.80, 145.60.

EUR/USD

EUR/USD continued its winning streak on Tuesday, trading above 1.1800 and reaching a high of 1.1868, its highest level since July. The euro found support among its peers, benefiting from hawkish comments from the European Central Bank. ECB board member Isabelle Schnabel said on Tuesday that interest rates in the eurozone are at a comfortable level, adding that upside risks to inflation remain dominant. EUR/USD rose, while the US dollar weakened, as market expectations grew for a 25 basis point rate cut by the Federal Reserve at its September meeting on Wednesday. The market also gave a slight chance of a larger 50 basis point rate cut, while also projecting continued easing until 2026 to counter recession risks. The Fed's Summary of Economic Projections and "Bitmap," which includes projections for the future federal funds rate by each Federal Open Market Committee (FOMC) member, will likely be closely watched.

At the start of the week, the EUR/USD uptrend remained intact, with the 14-day Relative Strength Index (RSI) on the daily chart rising above 65, indicating a clear upward momentum. Yesterday, the pair broke through its latest cycle high of 1.1780, reached on September 9th. It also rallied above the psychological 1.1800 level and the year-to-date high of 1.1830, laying the foundation for a move higher. It is now heading towards 1.1885 (the high of September 7, 2021), as well as the psychological 1.2000 level. On the other hand, if EUR/USD falls below 1.1800, sellers could push the exchange rate down to 1.1736 (the 9-day simple moving average). A break above the latter would expose the 1.1700 level (round-number mark).

Consider a long position on the Euro at 1.1850 today, with a stop-loss at 1.1840 and targets at 1.1910 and 1.1920.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Lebih Liputan

Pendedahan Risiko:Instrumen derivatif diniagakan di luar bursa dengan margin, yang bermakna ia membawa tahap risiko yang tinggi dan terdapat kemungkinan anda boleh kehilangan seluruh pelaburan anda. Produk-produk ini tidak sesuai untuk semua pelabur. Pastikan anda memahami sepenuhnya risiko dan pertimbangkan dengan teliti keadaan kewangan dan pengalaman dagangan anda sebelum berdagang. Cari nasihat kewangan bebas jika perlu sebelum membuka akaun dengan BCR.