0

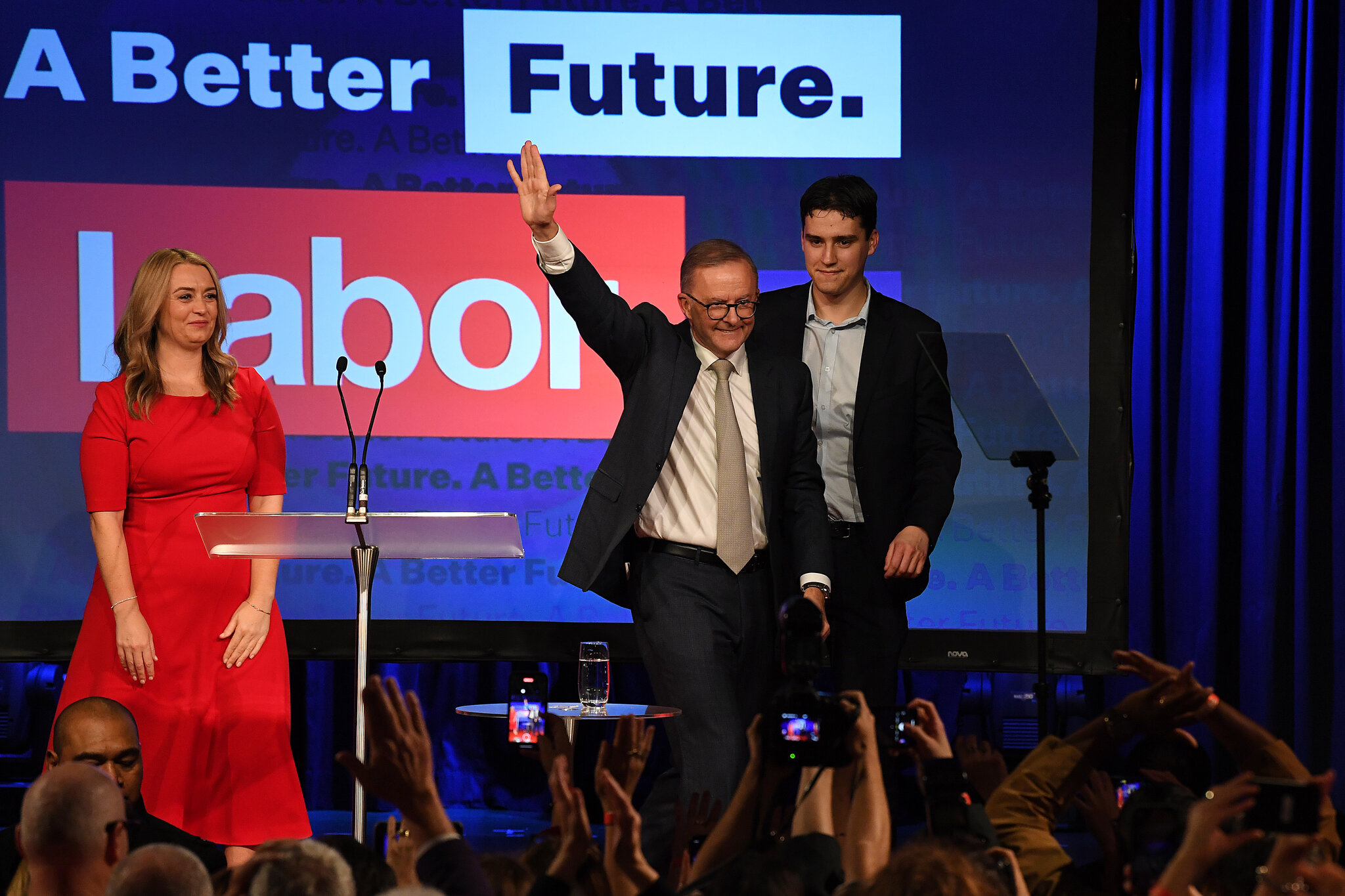

Australian equities retreated Monday despite a historic political milestone, as Prime Minister Anthony Albanese secured a rare second term — the first consecutive re-election of a sitting Australian leader in more than two decades. The market’s muted reaction underscores investor caution amid global economic uncertainties and light regional trading volumes due to multiple public holidays across Asia.

The S&P/ASX 200 index dropped 0.83%, pulling back from Friday’s high — its best close since late February — as traders digested the implications of political continuity and a shifting international landscape. While Albanese’s win signals voter support for stability, analysts noted that markets may be bracing for potential policy recalibrations or delays in reforms ahead.

Meanwhile, the Australian dollar edged 0.33% higher against the U.S. dollar, trading at 0.6462. Currency markets generally reflected a subdued but positive sentiment towards Albanese’s re-election and its implications for macroeconomic continuity.

Broader regional activity was subdued with markets in Japan, South Korea, Hong Kong, and mainland China closed for public holidays. However, in Taiwan, the Taiex index slipped 1.31% amid volatile trading, even as the New Taiwanese dollar strengthened sharply — appreciating 3.14% to 29.741 against the greenback, reaching its highest level in nearly three years.

China’s offshore yuan also saw modest gains, rising slightly to 7.206 per dollar, with earlier session movements marking its strongest level since November 2024.

In commodities, oil prices dropped sharply after the OPEC+ alliance announced plans to increase output for a second consecutive month. Brent crude futures fell 3.62% to $59.07 a barrel, while West Texas Intermediate crude declined nearly 4% to $56.00, as concerns over potential oversupply pressured prices lower.

U.S. equity futures pointed slightly downward in early Asian hours, suggesting a pause after a week of robust gains on Wall Street. On Friday, the S&P 500 advanced 1.47% to close at 5,686.67, notching its ninth straight day of gains — the longest winning streak since November 2004 — and fully rebounding from losses tied to renewed tariff threats earlier in April.

The Dow Jones Industrial Average surged 564 points to finish at 41,317.43, while the Nasdaq Composite rose 1.51% to 17,977.73, driven by tech optimism and easing rate expectations.

While Australia’s political scene has settled, financial markets are likely to remain sensitive to global cues — particularly upcoming central bank decisions, trade tensions, and energy dynamics — as investors weigh the resilience of the post-pandemic recovery.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

更多报道

风险披露:衍生品在场外交易,采用保证金交易,意味着具有高风险水平,有可能会损失所有投资。这些产品并不适合所有投资者。在进行交易之前,请确保您充分了解风险,并仔细考虑您的财务状况和交易经验。如有必要,请在与BCR开设账户之前咨询独立的财务顾问。

BCR Co Pty Ltd(公司编号1975046)是一家根据英属维尔京群岛法律注册成立的公司,注册地址为英属维尔京群岛托尔托拉岛罗德镇Wickham’s Cay 1的Trident Chambers,并受英属维尔京群岛金融服务委员会监管,牌照号为SIBA/L/19/1122。

Open Bridge Limited(公司编号16701394)是一家根据2006年《公司法》注册成立并在英格兰和威尔士注册的公司,注册地址为 Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX.本公司仅作为支付处理方运作,不提供任何交易或投资服务。