0

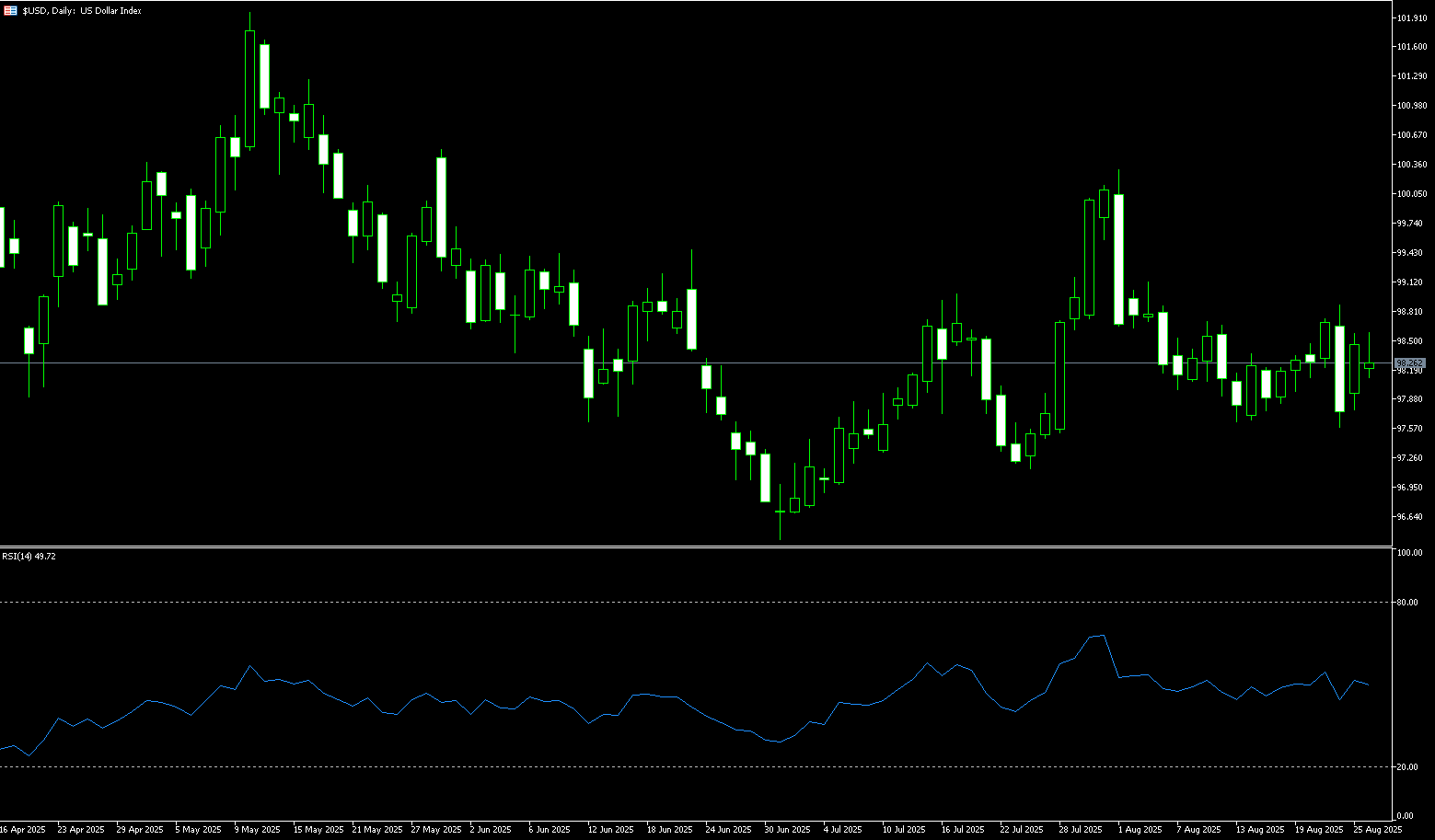

US Dollar Index

The US dollar index fell to around 98.20 on Tuesday, giving up gains from the previous session after US President Trump threatened to impose "follow-on tariffs" on US tech companies and export restrictions on advanced technology and semiconductors in response to a digital services tax. Meanwhile, the US dollar regained some stability and managed to partially absorb the impact of Powell's speech on Friday, starting the new trading week on a positive note. Earlier, President Trump announced the removal of Federal Reserve Governor Lisa Cook, accusing her of mortgage fraud. This move raised concerns about the Fed's independence and its ability to conduct monetary policy without political interference. Cook's dismissal could increase the likelihood of an earlier interest rate cut, as Trump has repeatedly pressured the central bank to lower borrowing costs. The market is currently pricing in an 83% probability of a 25 basis point rate cut by the Fed in September.

The US dollar index is currently trading at 98.20, down slightly on the day, but the overall trend is weak. From a technical perspective, the US dollar index is fluctuating in a narrow range between 98.00 (round mark) and 98.75 (89-day simple moving average), reflecting the market's digestion of the Fed's rate cut expectations and a wait-and-see attitude towards global economic data. On the daily chart, the US dollar index is below its 89-day moving average (98.75), while the 20-day moving average (98.45) poses short-term resistance. The 14-day relative strength index (RSI) is hovering between 45 and 50, indicating insufficient momentum and a lack of clear direction. If the US dollar index falls below 98.00, it could test 97.70 (early week low), with the next target being 97.19 (July 23 low). Conversely, a break above 98.45 could challenge the resistance level of 98.75.

Consider shorting the US Dollar Index at 98.33 today, with a stop-loss at 98.45 and a target of 97.90 to 97.80.

WTI Spot Crude Oil

WTI crude oil fell 2.2% to around $63.15 per barrel on Tuesday, retreating to a near three-week high reached the previous session, as investors weighed geopolitical risks and global demand concerns. The decline reflected broader risk aversion, with stock markets also under pressure, although the conflict in Ukraine and its impact on Russian fuel supplies remained central to crude oil trading. Monday's gains were driven by concerns about further disruptions following Ukrainian attacks on Russian energy infrastructure, which sparked fears of tightening US sanctions and worsening fuel shortages within Russia. President Trump warned of new sanctions against Moscow if peace talks stalled, despite reports of quiet discussions between US and Russian officials regarding energy deals. Meanwhile, the US threatened to impose significant tariffs on Indian exports for continued purchases of Russian crude oil, adding another layer of uncertainty to global trade flows.

WTI crude oil prices fell, reaching an intraday high of $64.95. While geopolitical risks are providing support for bulls, the overall market tone will remain neutral to bearish unless oil prices can hold above $65.76 (the 50.0% Fibonacci retracement level from $54.78 to $76.74). The 9-day simple moving average (SMA) at $63.06 has become a pivotal level in the bull-bear game. A clear break above $65 or below $63.19 would provide crude oil traders with the next clear directional signal. The 9-day SMA is currently acting as short-term support. A break below $63.06 would shift the focus to the low of $61.45 set on August 18. Furthermore, the upward trend faces multiple resistance levels: first, $64.95 (the early-week high), then $65.76, and finally the 200-day SMA at $67.18.

Consider going long on crude oil at 63.00 today. Stop-loss: 62.80. Target: 64.40, 64.60.

Spot Gold

On Tuesday, gold continued to rise, reaching a near two-week high above $3,390/oz. Markets believe the outlook for a September Fed rate cut remains uncertain. The US dollar index rose 0.49% on Monday, its largest single-day gain in nearly a month, suppressing gold prices. Furthermore, gold prices are facing a technical correction after last Friday's surge. Investors are awaiting Friday's US PCE inflation data with bated breath. This data storm may determine the next directional breakthrough for gold. Federal Reserve Chairman Powell's latest remarks are undoubtedly the core catalyst for recent gold price fluctuations. As a result, gold prices briefly climbed to a near two-week high last Friday, reflecting investors' optimistic expectations for loose monetary policy. In summary, while gold's short-term decline is being dragged down by a strong dollar and policy uncertainty, expectations of a Fed rate cut remain firmly rooted. The PCE data and the non-farm payroll report will be turning points. Investors should remain vigilant and consider initiating long positions on dips in the short term.

Gold confirmed a breakout from a descending wedge pattern on the 4-hour chart last week, subsequently retesting the broken resistance level and surging to a two-week high of $3,394 on Friday. This move confirms a bullish reversal structure and suggests renewed buying interest after a period of consolidation. Gold prices traded around $3,390 intraday, remaining above the 200-hour simple moving average at $3,352.50, which currently serves as immediate support. Momentum indicators continue to support the bullish tone: the relative strength index (RSI) remains around 68, indicating that upward momentum remains intact and has not yet entered overbought territory; the moving average convergence divergence (MACD) histogram is positive, suggesting further extension of the bullish momentum. Focus on multiple moving average support levels around 3,345-3,350. If gold prices fall below support near 3,345, they could retest the 100-day moving average, currently around $3,323.50. A break above $3,386.50 (Tuesday's high) would further solidify the momentum established on July 23rd towards the $3,400 mark and beyond, towards $3,439.00.

Consider going long on gold at 3,390 today, with a stop-loss at 3,385 and a target of 3,420-3,426.

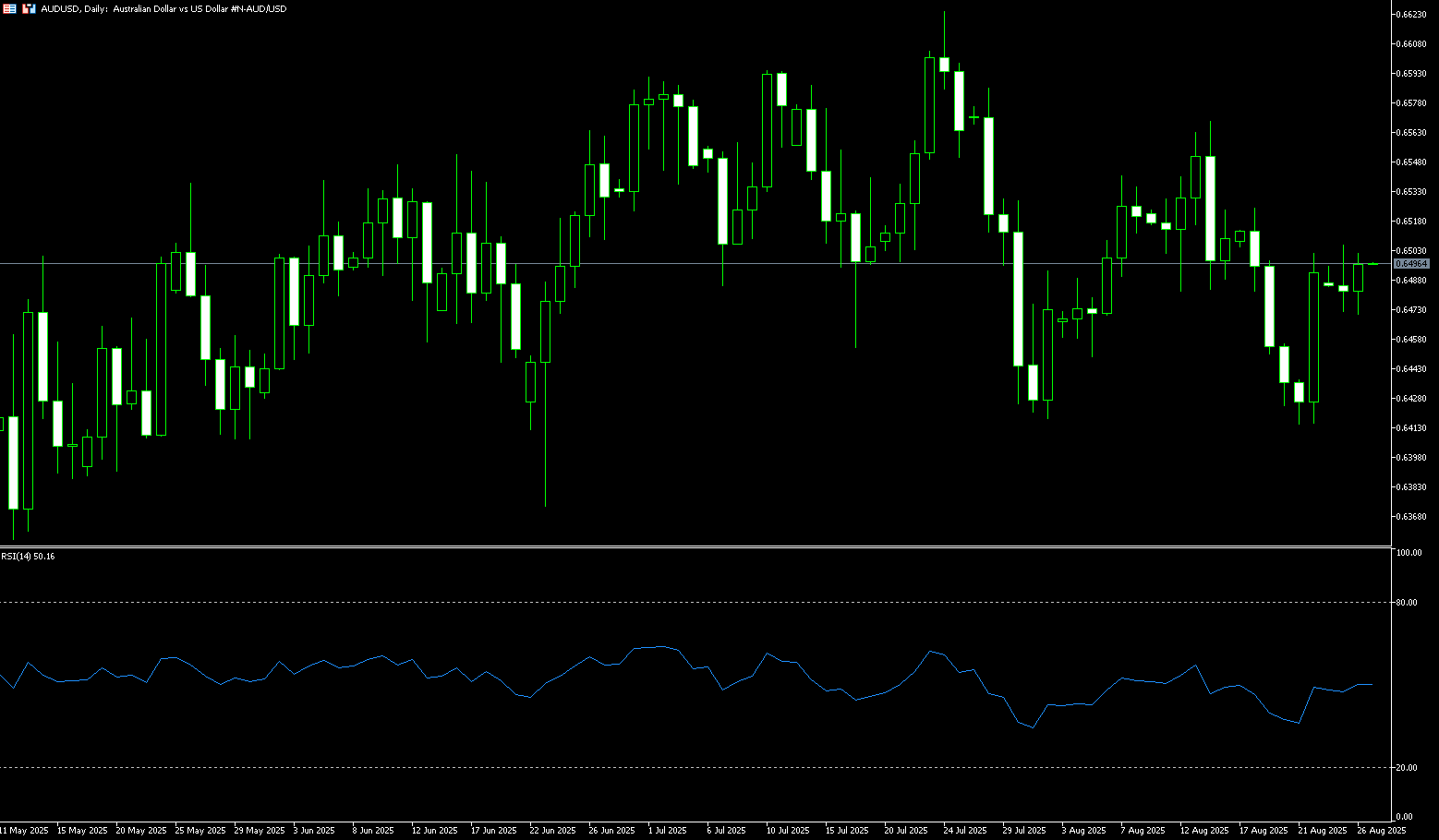

AUD/USD

The Australian dollar held steady around $0.6490 on Tuesday as investors weighed the latest Reserve Bank of Australia meeting minutes. The central bank hinted at the possibility of further interest rate cuts over the next year, with the pace of these cuts depending on incoming economic data. At its August 2025 meeting, the Reserve Bank of Australia (RBA) cut the cash rate by 25 basis points to 3.6% and indicated continued progress toward the midpoint of its 2-3% target range. While a gradual slowdown may be appropriate due to the still-tight labor market, strengthening private demand, and uncertainty surrounding the neutral interest rate, a faster pace may be necessary if labor conditions deteriorate sharply or global risks (such as an economic slowdown or a re-escalation of US trade tensions) affect the outlook. The market now expects the RBA to keep interest rates unchanged in September, with the possibility of another rate cut in November. Longer-term, interest rates could potentially reach 3.10% or even 2.85%.

The AUD/USD pair quickly rebounded after hitting 0.6414 last week, forming a pivot level at 0.6487, which it has repeatedly retested. The latest price is near 0.6490, approaching the central axis of the Bollinger Band on the daily chart at 0.6492. The short-term trend is shifting from a downward trend to a manageable upward trend with a pullback. If the market remains above the 6-day simple moving average of 0.6460, the market could turn from weak to strong. Regarding technical indicators, the MACD histogram is positive and expanding, suggesting bullish momentum. The 14-day relative strength index (RSI) is near 48 and approaching 65. Structurally, 0.6505 marks a significant previous high in this rebound (Monday's high). Above, resistance lies at 0.6505, followed by 0.6553 (the upper Bollinger Band line), and the monthly high of 0.6568 reached on August 14. Below, support is expected at the 6-day simple moving average of 0.6460. If this level breaks, last week's low of 0.6414 and 0.6400 (the round number mark) become more critical trend lines.

Consider going long on the Australian dollar at 0.6478 today, with a stop-loss at 0.6465 and targets at 0.6550 and 0.6540.

GBP/USD

On Tuesday, GBP/USD edged up to around 1.3480 after global markets reconsidered the rate-cutting frenzy sparked by Fed Chairman Powell's perceived dovish stance last weekend. Powell's remarks at the Jackson Hole Economic Symposium fueled expectations of a rate cut, but the latest batch of US Personal Consumption Expenditures (PCE) inflation data now looms large for investors this week. For pound traders, the UK economic data calendar is relatively quiet; with the London market closed for the extended weekend, Tuesday marked the first day domestic pound traders have re-entered the market since last Friday. The data calendar is dominated by a series of US economic data, culminating with the latest PCE inflation data on Friday. From a cross-market perspective, the US dollar index's weak rebound following the shift in interest rate expectations, a marginal improvement in risk appetite, and a decline in risk premiums in commodity and equity markets are all externally positive for the pound.

GBP/USD paused its gains following Powell's dovish stance. A renewed wave of dollar buying halted the day's gains, dragging the pair back into its familiar consolidation range below the 50-day exponential moving average at 1.3492. However, the pair remained consolidating above the 100-day exponential moving average at 1.3463. The 14-day Relative Strength Index (RSI) is near 50, suggesting a slightly stronger GBP/USD pair in a neutral position. If the pair can re-establish itself above 1.3500, it could test resistance at last week's high of 1.3544. A break above 1.3544 would target the August 14 high of 1.3594, followed by 1.3600. On the other hand, a break below the 100-day simple moving average at 1.3463 would pave the way for a pullback to 1.3400 (round-number mark), and 1.3345 (August 7 low), before resuming the uptrend.

Consider a long position on GBP at 1.3468 today, with a stop-loss at 1.3455 and targets at 1.3540 and 1.3550.

USD/JPY

The yen rose to around 147.30 per dollar on Tuesday, recovering from losses in the previous session as the greenback came under pressure after US President Donald Trump announced the dismissal of Federal Reserve Governor Lisa Cook for alleged mortgage fraud. This move raised concerns about the Fed's independence and its ability to keep monetary policy free from political influence. Domestically, Bank of Japan Governor Kazuo Ueda said on Saturday that Japanese wages are expected to rise further as the labor market tightens, suggesting that conditions are forming for another interest rate hike. At its July meeting, the Bank of Japan kept interest rates unchanged but raised its inflation forecast and offered a more optimistic economic outlook. Traders are also looking ahead to a series of key Japanese economic data due later this week, including industrial production, retail sales, and consumer confidence data.

At the start of this week, USD/JPY saw renewed buying below 147.00. Throughout August, USD/JPY has tested this level 10 times but has failed to break through. Unless the pair closes below 147.00 and the 50-day moving average of 146.91 below it is also breached, this range remains a solid area for traders to consider initiating long positions. On the upside, watch for the 148.00 round number, which could signal a continued rally, with 148.78 (last week's high) in focus. A break above this level could open up bullish momentum towards the psychologically important 150.00 mark. Support lies below last week's low at 146.87, followed by the 146.00 level (round number), and the 100-day simple moving average at 145.50.

Consider shorting the US dollar at 147.63 today. Stop-loss: 147.85, target: 146.60, 146.40.

EUR/USD

The euro weakened against the US dollar on Monday, with EUR/USD retreating below the psychological level of 1.1700 as the greenback regained modest strength following dovish comments from Federal Reserve Chairman Powell at the Jackson Hole symposium. EUR/USD depreciated after gaining around 1% on Friday. However, downside for the pair may be limited as the US dollar is likely to continue to weaken due to the increasing likelihood of a Fed rate cut in September, stemming from comments made by Fed Chairman Powell at the Jackson Hole symposium on Friday. ECB Governing Council member Joachim Nagel stated at Jackson Hole that the central bank would need a significant change in the economic outlook before lowering borrowing costs again.

The daily chart shows that the EUR/USD uptrend appears to have resumed in late last week. After reaching last week's high of 1.1742, the market is anticipating a move towards 1.1800. The 14-day Relative Strength Index (RSI) has re-entered above 49.00, indicating a bullish trend. The index is rising and poised to surpass its recent high. The pair's first resistance level is last week's high of 1.1742, followed by the psychologically important 1.1800 level. A break above this level would target the year's high of 1.1830. On the other hand, a daily close below 1.1600 would open the door to a test of the 75-day simple moving average at 1.1550. A break below this level would target the 89-day simple moving average at 1.1506 and the 1.1500 round-figure mark.

Today, you can consider going long on EUR at 1.1632, stop loss: 1.1620, target: 1.1685; 1.1695

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

การเปิดเผยความเสี่ยง:ผลิตภัณฑ์เดริวเทรียลนี้ถูกซื้อขายนอกระบบด้วยการมาร์จิ้นซึ่งหมายความว่ามีความเสี่ยงสูงและมีโอกาสที่คุณอาจสูญเสียการลงทุนทั้งหมดได้ ผลิตภัณฑ์เหล่านี้ไม่เหมาะสำหรับนักลงทุนทุกคน โปรดตระหนักถึงความเสี่ยงอย่างเต็มที่และพิจารณาอย่างรอบคอบสถานการณ์การเงินและประสบการณ์การซื้อขายของคุณก่อนที่จะซื้อขาย หากจำเป็นกรุณาสืบค้นคำแนะนำทางการเงินอิสระ